Volume 13 Issue 2 *Corresponding author julianacarvalhotrece@yahoo.com Submitted 01 july 2025 Accepted 15 ago 2025 Published 10 oct 2025 Citation TRECE, J. C. C. The Influence of the Political Context on the deindustrialization of Rio de Janeiro. Coleção Estudos Cariocas, v. 13, n. 2, 2025.

DOI: 10.71256/19847203.13.2.154.2025 The article was originally submitted in PORTUGUESE. Translations into other languages were reviewed and validated by the authors and the editorial team. Nevertheless, for the most accurate representation of the subject matter, readers are encouraged to consult the article in its original language.

| The influence of the political context on the deindustrialization of Rio de Janeiro A influência do contexto político na desindustrialização do Rio de Janeiro La influencia del contexto político en la desindustrialización de Río de Janeiro Juliana Carvalho da Cunha Trece¹ 1Instituto Brasileiro de Economia, Rua Presidente Carlos de Campos, 417, Laranjeiras,

Rio de Janeiro, RJ, https://orcid.org/0000-0002-9365-1720, julianacarvalhotrece@yahoo.com

AbstractIn this article, the deindustrialization of Rio de Janeiro is analyzed, as the state has recently shown one of the worst economic performances in the country, marked by a sharp decline in the manufacturing sector. The city of Rio de Janeiro emerges as the epicenter of this deindustrialization, rooted in its historically fragmented political relationship with the rest of the state, which has hindered the formation of a regional development strategy. Despite the challenges posed by the state’s oil dependency, the energy transition could represent an opportunity for reindustrialization, if institutional changes support regional development and economic diversification. Keywords: Rio de Janeiro, deindustrialization, political fragmentation. ResumoNeste artigo analisa-se a desindustrialização fluminense, pois o Rio de Janeiro tem apresentado, recentemente, um dos piores desempenhos econômicos do país, com forte deterioração da indústria de transformação. Destaca-se o município do Rio de Janeiro como o epicentro da desindustrialização estadual, com origem na história política fragmentada da cidade com o restante do estado, que influenciou na ausência de projeto regional de desenvolvimento fluminense. A transição energética, apesar de desafiadora, dado o perfil petrolífero do estado, pode ser uma oportunidade para a sua reindustrialização, caso sejam realizadas mudanças institucionais que estimulem o desenvolvimento regional e a diversificação econômica. Palavras-chave: Rio de Janeiro, desindustrialização, fragmentação política. ResumenEste artículo analiza la desindustrialización de Río de Janeiro, que ha mostrado recientemente uno de los peores desempeños económicos de Brasil, con fuerte caída en la industria manufacturera. La ciudad de Río de Janeiro se destaca como el epicentro de este proceso, debido a su histórica fragmentación política con el resto del estado, lo que ha dificultado la formulación de una estrategia regional de desarrollo. A pesar de los desafíos impuestos por el perfil petrolero del estado, la transición energética puede representar una oportunidad de reindustrialización, si se implementan cambios institucionales que promuevan el desarrollo regional y la diversificación económica. Palabras clave: Río de Janeiro, desindustrialización, fragmentación política. |

Introduction

The political environment exerts significant influence over the economic environment, as the way the State acts, or fails to act, can attract or repel investments. In recent years, most investments in the state of Rio de Janeiro have been related to specific characteristics, such as the existence of oil reserves or its tourist profile. In terms of the development of an industrial productive chain, little has been observed compared to other states of the federation.

Consequently, the fluminense[1] manufacturing industry, an activity with significant power to generate economic linkages, has been deteriorating, to such an extent that, among all 27 states of the federation, Rio de Janeiro was the only one to show a real contraction of this activity between 1985 and 2022. This was reflected in acute deindustrialization in the state, with a large part of its intensity explained by the performance of the city of Rio de Janeiro, which showed widespread shrinkage across various industrial segments.

The major positive highlight of the fluminense economy today is the extractive industry, explained by the existence of oil reserves, which make the state the largest producer of this product in the country. However, due to its poorly diversified productive structure, the high dependence on oil production, a finite natural resource, has brought broad economic vulnerability to the state, which is likely to be aggravated by the energy transition, one of the main items on the global agenda today.

Despite being challenging for the state, the energy transition can also be an alternative for reviving industry in Rio de Janeiro, through regional development planning that encourages its reindustrialization focused on low-carbon activities, a market with great potential for expansion. Reversing fluminense deindustrialization is not trivial, but it is not impossible either. However, for this process, the institutional strengthening of the State and its commitment and seriousness regarding economic development are crucial. Without an improvement in the political environment, it will be unviable for a state experiencing multiple crises to take advantage of the opportunities generated by the energy transition, and there could even be an intensification of pre-existing challenges.

The power of institutions and efficient policy is reflected in a qualified workforce, the creation of an environment conducive to innovation, the attraction of companies that can stimulate the economy and the job market, and that contribute to the state entering a virtuous cycle of prosperity. Therefore, an environment favorable to economic development begins with a stable political environment.

In addition to this introduction, this article consists of five more sections. The second section presents a brief historical analysis of the economic and social formation of Rio de Janeiro, highlighting the origin of its current institutional weaknesses, which culminated in crises in multiple spheres. The third section presents the data used for the analysis, the necessary treatments, and the methodology adopted to measure deindustrialization in the state. The fourth section presents the analysis of the economic results, highlighting the performance of the manufacturing industry and the role of the city of Rio de Janeiro in the state's deindustrialization process. The fifth section addresses how the energy transition can be an opportunity for reindustrialization in the state. Finally, the sixth section emphasizes the importance of changing the way political institutions operate in the state so that, through planning and commitment, the fluminense trajectory can be transformed towards a new cycle of prosperity.

Brief Economic Historical Context

This section presents characteristics of the economic and social formation of the state of Rio de Janeiro in a non-exhaustive manner. The objective is to highlight how the differences in the state's formation contributed to its political fragmentation. It also highlights how this fragmentation favored, over time, the outbreak of crises in various spheres, which directly affected the performance of the state's economy.

- Social Formation of the State of Rio de Janeiro

In 1763, the city of Rio de Janeiro became the capital of the Portuguese Colony of Brazil, which contributed to the attraction of many investments, which became even greater with the arrival of the Royal Family in 1808, a moment when the city became the seat of the United Kingdom of Portugal, Brazil, and the Algarves, which contributed to strengthening it as the commercial-financial center of Brazil (Osório and Versiani, 2015). In 1822, with the Proclamation of Brazil's Independence, Rio de Janeiro became the Capital of the Empire of Brazil, and in 1889, with the Proclamation of the Republic, Rio de Janeiro became the Capital of the Republic, at the beginning of federalism in Brazil.

These events contributed to the economy of this city, and its immediate surroundings, developing around the needs of the various conditions of capital, supplying the high availability of labor, mainly in the provision of services; the rest of the state was quite rural.

The main economic activity in the interior of Rio de Janeiro was large estate coffee production, based on slave labor. This activity began to deteriorate at the end of the 19th century, influenced by the abolition of slavery and the reduction in the price of coffee on the world market (Vieira, 2001). Furthermore, the lack of modernization of production, without the same increment of machinery observed in other regions of the country, and the adoption of techniques harmful to soil fertility, contributed to the sharp reduction in coffee production in the state, which influenced its weak economic performance (Vieira, 2001).

Another important characteristic, during the 20th century, was the intensification of the migratory process, which contributed to the significant expansion of the population of the city of Rio de Janeiro. Consequently, urban spaces, which were already largely occupied, became more expensive due to the scarcity of areas for the construction of new ventures. The high attraction of investments in the city throughout its history contributed to real estate speculation, which became more evident from the urbanization process in the mid-1930s (Ferreira, 2018). As a consequence of the increasing cost of living in the city, there was greater population sprawl, a process in which many people migrated to neighboring municipalities, where the cost of living was lower compared to the capital.

This phenomenon was of great importance for the strengthening of interdependence between the municipalities of the state, mainly in its metropolitan region. While the capital offered a wide range of job opportunities, the neighboring municipalities often became dormitory cities to which people returned only to rest (Ferreira, 2018). This process ended up generating a hierarchy of the city of Rio de Janeiro over the other municipalities, since economic decision-making was centered in this city, which, in turn, served national interests, as it was the Capital of the Republic of Brazil.

The population swelling in the city of Rio de Janeiro also influenced the process of favelization, characterized by occupation in the hillside areas of the cities. To deal with the expansion of favelas, the State created the "parques proletários" (proletarian parks) and housing complexes in the mid-20th century, with the objective of transferring inhabitants from the hills to locations far from the central area. These places, however, ended up "repeating the processes of favela growth and saturation of installed infrastructure," with precarious provision of public services, where there was often no "street layout, urban planning, water, or light," thus establishing a "separate city" (Portal MultiRio, s.d.).

This conjuncture created an environment conducive to the emergence of organized crime in these locations. It is from this that "images emerged that made the favela a place of danger, to be eradicated; of lack and deprivation, very different from the residences of the rest of the urban population considered 'civilized'" (Portal MultiRio, s.d.).

The beginning of the industrialization process in Rio de Janeiro followed the logic of prioritizing national demands over local ones, with the development of specific industries that were not planned for the development of a regional chain. Unlike what happened in São Paulo, for example, where, in addition to federal investments, resources generated by coffee production played a relevant role in the industrialization of that state, in Rio de Janeiro state presence was dominant in investments (Pedreira et al., 2024). Notable examples, as cited by Osório and Versiani (2015), are federal investments in the region "such as the installation of the Companhia Siderúrgica Nacional [National Steel Company] (1941); the Fábrica Nacional de Motores [National Motor Factory] (1942); the Companhia Nacional de Álcalis (1943) and the Refinaria Duque de Caxias [Duque de Caxias Refinery] (1961)", which reinforces the central role of the federal capital and the state of Rio de Janeiro in the Brazilian economy of the time.

In 1960, the federal capital was transferred to Brasília, with the objective of making its location geographically central and ensuring the settlement and control of regions further away from the South axis of Brazil (Ceballos, 2005). Consequently, Rio de Janeiro became, until 1975, the only municipality constituting the state of Guanabara, thus benefiting from the collection of taxes at both the municipal and state levels. This further increased the investment discrepancies that already existed between Rio de Janeiro and the other municipalities that comprised the state at that time.

In terms of investment attraction, however, a reduction was noted in the state with the departure of the federal capital from the city of Rio de Janeiro (Osório and Versiani, 2015). Industry was one of the activities that felt the effects of this change most acutely, as

The economic development that occurred in Rio de Janeiro always followed in the wake of its capital status; there was no Long-Term planning on the part of the carioca business community aiming to become independent from federal investments or the income from public employees and companies. The capital status and the benefits inherent to it meant that the carioca business community did not learn to walk on its own, becoming, in general, dependent on investments and initiatives generated by the public power, and this occurred even though it was known to all that the elevation of the city to the capital of the republic had a transitional character (Costa, p. 16, 2010).

In 1975, Guanabara was extinguished and the municipality of Rio de Janeiro began to integrate the state of Rio de Janeiro as its capital, giving rise to the current formation of the fluminense territory. The federal government's main justification for the merger of the two states was to contribute to integrated economic development in the region, making it a national development pole. Guanabara had physical space restrictions for industrial expansion, but, by merging with the state of Rio de Janeiro, which was relatively less industrialized, industrial expansion could occur in the territory (Ferreira, 2006). Furthermore, the political factor was also an important motivating aspect for this merger.

From a political aspect, the merger reduced the weight of the Brazilian Democratic Movement (MDB) party of Guanabara. Consequently, the "merger, instead of creating conditions for the new state to represent a consistent force on the national scene, in reality encouraged political struggle, which made the construction of a new regional identity unviable" (Ferreira, 2006). Thus, the idea of creating an integrated state clashed with the political fragmentation created by the unification of different regional political bases that did not intend to lose their autonomies. It is observed, therefore, that the absence of political unification of the new state of Rio de Janeiro contributed to little being proposed in terms of elaborating a project for effective regional development. Since then, the political crisis in the state, although with more acute and mild moments, has in a way persisted.

In practice, although there was economic dependence between the municipality of Rio de Janeiro and the others in the state, the merger "administratively reunited two entities that had never been united" (Pedreira, et. al, 2024), which contributed to the generation of great political tension in the state. The political fragmentation formed by the unification of different political bases harmed the establishment of regional development for Rio de Janeiro, as the priority was the dispute for state power.

The economic structuring of the state reflected this politically fragmented environment, with the establishment of "a dispersed set of sectoral specializations in a region and with little coherence from the point of view of a territorial division of labor," characterized by a fragile productive base and vulnerable to external events, typical of a hollow productive structure (Sobral, 2017).

According to historian Marly Motta, the "singularity of the former Guanabara was nullified in favor of its integration into the new state of Rio de Janeiro." This makes us reflect on the limits and possibilities of a project like the merger. Motta continues: "whose implementation would have to deal with the political identity of two regions forged by the memory that each one of them built of its own past. On one side, the city of Rio de Janeiro, capital of the country for more than a hundred years, for 15 years occupying a singular place in the federation, that of state-capital, and struggling to conserve its traditional role as the 'country's sounding board'; on the other, the former state of Rio, the 'Old Province', divided between the attraction of the 'marvelous city' and the fear of suburbanization" (Portal MultiRio, s.d.).

Osório and Versiani (2015) termed this period of the federal capital's departure from the city of Rio de Janeiro, and the subsequent unification of Guanabara with the state of Rio de Janeiro, as one of "economic emptying" due to the reduction in the level of investments in the state and the departure of various companies and people, which contributed to increased unemployment and reduced economic activity in the state, mainly of an industrial nature. Thus, Rio de Janeiro found itself devoid of a regional identity, a phase that lasted until the discovery of oil in the state.

The first oil well in Rio de Janeiro was discovered in the Campos Basin in 1974. From the 1980s onwards, the state became a reference in oil production in the country, which modified its productive structure and made oil production, and later also natural gas, the new identity of the fluminense economy. The state once again began to attract substantial investments, not only concentrated in its capital but also in other municipalities. In 2005, with the start of production in the Santos Basin, the relevance of Rio de Janeiro in the national production of oil and natural gas was further expanded (Souza, 2019).

The voluminous inflow of investments into the oil sector, in a way, reduced the focus on the structural deficiencies of the fluminense economy. The political problems, however, remained. Since the state's unification in 1975, of the fourteen politicians who governed Rio de Janeiro, six were arrested or removed due to involvement in corruption schemes[2]. Despite the expressive growth of the extractive industry, the other activities presented one of the worst performances in the country, according to data from the IBGE's Regional Accounts System. The high political instability of Rio de Janeiro influenced the performance of these activities by contributing to scaring away investments. Consequently, the increase in the state's economic dependence on the production of natural resources, coupled with the weak economic performance in other activities, made it increasingly susceptible to various types of self-reinforcing crises.

- Outbreak of Crises in Rio de Janeiro

The brief historical contextualization of the economy of Rio de Janeiro showed two types of dependence in its structure over time. The first due to development concentrated in its capital, and the second, due to the concentration of the economic structure on oil and natural gas production activity.

In both cases, there was no extensive planning in the state for this configuration. The fact of being the capital, or the fact of having oil and natural gas reserves, are characteristics determined, respectively, by serving national interests and geographical location. In a way, this may have contributed to the state being less than proactive in structuring an industrial productive chain, aligned with a project of regional development. What was established in Rio de Janeiro was a weakened State, with difficulties in dealing with the various existing crises.

Rio de Janeiro has been experiencing, for years, a situation of grave fiscal crisis, being the state with the largest public debt in the country, according to data from the State Secretariat of Finance. The unification in 1975, with the extinction of Guanabara, resulted in a loss of state revenues that were destined for that state, and generated a commitment of its public accounts (Motta, 2001).

In the 1990s, this scenario changed with the establishment of payments of royalties and special participations for the production of oil and natural gas, which favored Rio de Janeiro, the largest producer in the country, according to ANP data. However, the dimension that these revenues gained in the finances of the state and its municipalities made it vulnerable to fluctuations in the price of a barrel of oil. Rio de Janeiro did not plan adequately for price volatility, not having invested these resources significantly in the development of other economic activities to reduce dependence. In reality, a certain "financial complacency due to the substantial oil revenues" was noted, which resulted in the abandonment of planning to diversify the productive structure (Ribeiro and Azevedo Neto, 2024).

Given this context, the risk to the fluminense economy intensified over time, with a poorly diversified economy dependent on a volatile activity. In 2015, with the sharp fall in the world price of a barrel of oil, the reduction in the level of state revenues was significant, which aggravated its fiscal situation.

The acute process of deindustrialization in the state also contributed to the reduction in its level of revenues over time. However, as there was a large inflow of resources from financial compensation for extractive activity, the reduction in industrial revenues was largely compensated. This process, although not abrupt, has been quite intense over the years, with the closure of various companies and factories in Rio de Janeiro and the consequent loss of jobs in the activity.

With the absence of state action in marginalized areas, criminal factions, over time, developed and became extremely powerful, generating a context of civil war, where the main victims are the residents of marginalized areas, who experience a constant feeling of insecurity, compromised right to come and go, due to orders to close roads, and increased crime.

It is noted that, in different aspects, the absence of the State, whether in managing oil revenues for economic diversification, in establishing a housing plan, in providing quality public services, in structuring a regional development plan, negatively affected the economy and society.

In an interview with the newspaper El País, Professor Mauro Osório, a specialist in the fluminense economy, highlighted that the state's fiscal crisis is due "to an absurd drop in tax revenues, oil royalties, and federal transfers in a State with failed planning, dependent on oil, and with a still hollow productive structure" (Martín, 2016), which summarizes the current situation of Rio de Janeiro.

Methodology and Database

To understand the intensity of deindustrialization in Rio de Janeiro, data from the IBGE's Regional Accounts System (SCR), the Ministry of Labor and Employment's Annual List of Social Information (RAIS), and the IBGE's Annual Industrial Survey (PIA) were analyzed. These sources allowed for the measurement of fluminense deindustrialization through value-added and employment data. As it is a historical analysis, treatments were performed to make the historical series compatible. Due to classification changes, which naturally occur over time, some adaptations were necessary for comparability and increased coherence of the information. This section begins with the presentation of the concept of deindustrialization and its importance for the analysis of economic development. Subsequently, the treatments performed on the database are detailed.

- Deindustrialization: Concept and Importance for Analysis

According to Squeff (2012), Kaldor found that, since the manufacturing industry generally presents a higher level of productivity than other economic activities, the increasing relevance of this type of activity in the economy raises the average productivity of a country, with positive effects on its GDP growth[3]. Furthermore, Squeff (2012) highlights that this activity has a great capacity to generate positive externalities, by fostering both the supplier value chain (increased demand for products from agriculture and extractive industries, to be transformed) and the demand chain (increased demand for services such as trade of manufactured products, transportation to final consumers, financial intermediation for acquisition, among others), which makes it an important driver of economic growth.

The manufacturing industry cited by Kaldor refers to the transformation industry. This industry encompasses various activities that, to different degrees, involve the application of production functions, from primary products, or even already derived ones, to create transformed products that usually involve some degree of technological application. For this reason, the transformation industry is considered to have "high potential to leverage the economic and social development of a nation, especially for countries in intermediate stages of development like Brazil." (Morceiro, 2011).

Given the importance of the transformation industry for economic development, it becomes relevant to analyze deindustrialization processes, which are those where there is a loss of participation of this activity in the economy. By identifying the causes that lead to this reduction, one can understand the effects on economic development.

According to Squeff (2012), changes in the sectoral composition of countries are observed over time, as they develop. Initially, there is a reduction in the participation of agriculture, due to the intensification of industry. Over time, however, with the increased demand for services, these begin to gain greater participation in the economy, at the cost of a reduction in industrial participation.

Two characteristics should be emphasized in the described movement: (i) the loss of industry participation in the economy is expected as countries develop, and (ii) there is not necessarily a contraction of the industry; the observed loss of participation may only be relative.

It is concluded, therefore, that deindustrialization is not always problematic if it is a consequence of the economic development process in which, over time, a reduction in the participation of agriculture is observed, due to the intensification of industry, which, with a subsequent increase in the participation of services, due to increased demand for them (Squeff, 2012). In this case, deindustrialization is not due to a contraction in the transformation industry, but rather to growth in the service sector at rates higher than those of industry.

Deindustrialization, therefore, becomes a problem if it occurs prematurely, not being a result of the "natural" process of greater demand for services, but rather due to deficiencies in industrial development, with effects of reducing the long-term potential economic growth of a country (Morceiro, 2011).

In the literature on deindustrialization, various forms are used to measure it, the most used, according to Squeff (2012), being those that measure its weight in levels of production (value added and employment)[4].

- Database

The data from the IBGE's Regional Accounts System (SCR) used in this article refer to the value added of the transformation industry and the GDP for the 27 states of the federation. In the current methodological reference of the SCR, 2010, data is available from 2002, but the IBGE has regional data in the previous methodological reference from 1985.

The Annual List of Social Information (RAIS) from the Ministry of Labor and Employment, is an administrative record with various information, the ones used in this article being those related to formal employment links as of December 31 of each year. It is a relevant database for analyzing employment dynamics as it presents data from 1985, with extensive geographical and economic activity detail.

In this article, data were collected for segments of the transformation industry activity and for the total economy in three distinct periods. From 1985 to 1994, the "IBGE Subsetor" activity classification was used. Between 1994 and 2005, the "CNAE 95 Grupo" was adopted, and from 2006 onwards, information was collected in the "CNAE 2.0 Grupo", the current classification adopted by the IBGE.

The information on transformation industry activities was made compatible into seven segments. This compatibility was possible because the "IBGE Subsetor" classification, for example, has data even after 1994, which allowed comparison of the series with the other classifications; the same occurs with the "CNAE 95 Grupo", which can be compared with the "CNAE 2.0 Grupo". Table 1 details the disaggregation of the transformation segments analyzed and the treatments performed for the elaboration of the historical series from 1985 to 2024.

Table 1: Translation of the classification of transformation industry segments for compatibility of the historical series of formal employment links

Activities | IBGE Subsetor - 1985 to 1993 | CNAE 95 Grupo - 1994 to 2005 | CNAE 2.0 Grupo |

Food and beverages | Variation by code 13 | Code 15 | Sum of codes 10 and 11 |

Textiles, apparel, and footwear | Variation by the sum of codes 11 and 12 | Sum of codes 17, 18 and 193 | Sum of codes 13, 14, 153 and 154 |

Paper, cardboard, and printing | Variation by code 08 | Sum of codes 21 and 22, excluding code 221 | Sum of codes 17 and 18 |

Chemicals | Variation by code 10 | Sum of codes 23, 24 and 252 | Sum of codes 19, 20 and 21 |

Metallurgy | Variation by code 03 | Sum of codes 27 and 28 | Sum of codes 24 and 25 |

Machinery | Variation by the sum of codes 04, 05 and 06 | Sum of codes 29, 30, 31, 32, 33, 34 and 35 | Sum of codes 26, 27, 28, 29 and 30 |

Other | Variation by the sum of codes 02, 07 and 09 | Sum of codes 16, 191, 192, 20, 251, 26, 361, 369 and 37 | Sum of codes 12, 151, 152, 221, 23, 321, 322, 323, 324 and 329 |

Source: Adapted from MTE-RAIS. Own elaboration.

Economic Weakening of Rio de Janeiro

This section analyzes the economic performance of Rio de Janeiro from 1985 to 2024. It begins with the presentation of the variation rates of value added by economic activities and the identification of the fluminense economy's performance as the worst in the country. Subsequently, the evolution of deindustrialization in Rio de Janeiro is presented, highlighting the relevance of the performance of the transformation industry in the city of Rio de Janeiro in this process.

- Performance of Fluminense GDP compared to other states

Table 2 presents the accumulated real variation rates of GDP and value added in three major economic activities (agriculture, industry, and services) and, with detail on four industrial activities, in the 27 states of the federation, between 1985 and 2022, based on SCR data. It is observed that the performance of the fluminense GDP was the worst in the country in the period, as was the value added in agriculture and the services sector. In the total industry, it only did not occupy the last position due to the performance in the extractive industry. In an exercise of excluding this activity from the industry, Rio de Janeiro would also occupy the last position in the country in industrial activity.

Table 2: Accumulated Real Variation of Value Added, between 1985 and 2022, by Economic Activities and States of the Federation – in %

States of the Federation | Agricul-ture | Industry | Services | GDP |

Extrativa | Transformation | SIUP | Construction | Total |

RJ Ranking | 27 | 3 | 27 | 24 | 27 | 20 | 27 | 27 |

RO | 254,3 | 316 | 267,1 | 1639,1 | 151 | 307,7 | 238,1 | 282,7 |

AC | 64,2 | - | 486 | 1035,8 | 187,5 | 243,1 | 212,4 | 224,7 |

AM | 10,6 | 200,6 | 975,1 | 614,8 | 220,8 | 818,1 | 268,3 | 561,9 |

RR | 1195,4 | - | 215,4 | 4897,7 | 340,3 | 279 | 436,5 | 478,6 |

PA | 224 | 596,3 | 27,5 | 1419,5 | 348,2 | 209,8 | 222,4 | 227,5 |

AP | 157,7 | -42,3 | 78,6 | -3203 | 172,2 | 119,4 | 362 | 305,7 |

TO | 555,3 | - | 925 | 1300,2 | 110,1 | 269,8 | 174,6 | 253 |

MA | 141,1 | - | 294,3 | 1022,2 | 66,8 | -43,4 | 249,9 | 238,6 |

PI | 784,8 | - | 342,4 | 2740,1 | 148,1 | 175,7 | 136,5 | 243,1 |

CE | 68,4 | -74,8 | 59,2 | 753,7 | 378 | 141,8 | 175,8 | 175,9 |

RN | 298,6 | -30,8 | 158,7 | 925,2 | 140,2 | 107,6 | 164,2 | 163,9 |

PB | 74,2 | - | 497,6 | 654,5 | 154,2 | 222,9 | 129 | 188,6 |

PE | 198,8 | 413,2 | 31,8 | 173,9 | 49,1 | 42,9 | 126,5 | 108 |

AL | 165 | - | 72,6 | 275,5 | 144,2 | -61,3 | 129,7 | 131,7 |

SE | 149,7 | -79,9 | 62,9 | 248,6 | 50,9 | 94,8 | 143 | 134,2 |

BA | 139,2 | -24,5 | 57,4 | 122,6 | 92,6 | 63,5 | 130,7 | 107,3 |

MG | 229,2 | -24,4 | 45 | 92,7 | 167,2 | 53,1 | 140,8 | 121,7 |

ES | 251,3 | 128,5 | 70,9 | 136,2 | 155,4 | 108,3 | 160 | 151,1 |

RJ | 6,4 | 536,5 | -20,2 | 135,2 | 12,1 | 73,3 | 74,1 | 77,3 |

SP | 117,8 | 699,7 | 16 | 212,3 | 69,3 | 38,4 | 143,3 | 106,2 |

PR | 242,9 | -38,9 | 129,1 | 481 | 134,5 | 147,2 | 167,9 | 186 |

SC | 228 | -59,7 | 70,6 | 407 | 274 | 104,6 | 215,9 | 190,2 |

RS | 50,1 | -15,7 | 37,3 | 188,9 | 105,6 | 55,4 | 103,9 | 91,5 |

MS | 290,4 | 133,1 | 634,5 | 545,4 | 111,8 | 387,8 | 204,9 | 276 |

MT | 4366,4 | 44,2 | 808,7 | 1857,9 | 280,3 | 631 | 398,2 | 811,1 |

GO | 436,3 | 152,6 | 253 | 177,4 | 134,9 | 183,8 | 181,8 | 215,4 |

DF | 229,9 | 159,6 | 273,1 | 317,6 | 124,3 | 167,9 | 185,2 | 188,7 |

Source: IBGE. Regional Accounts System. Own elaboration.

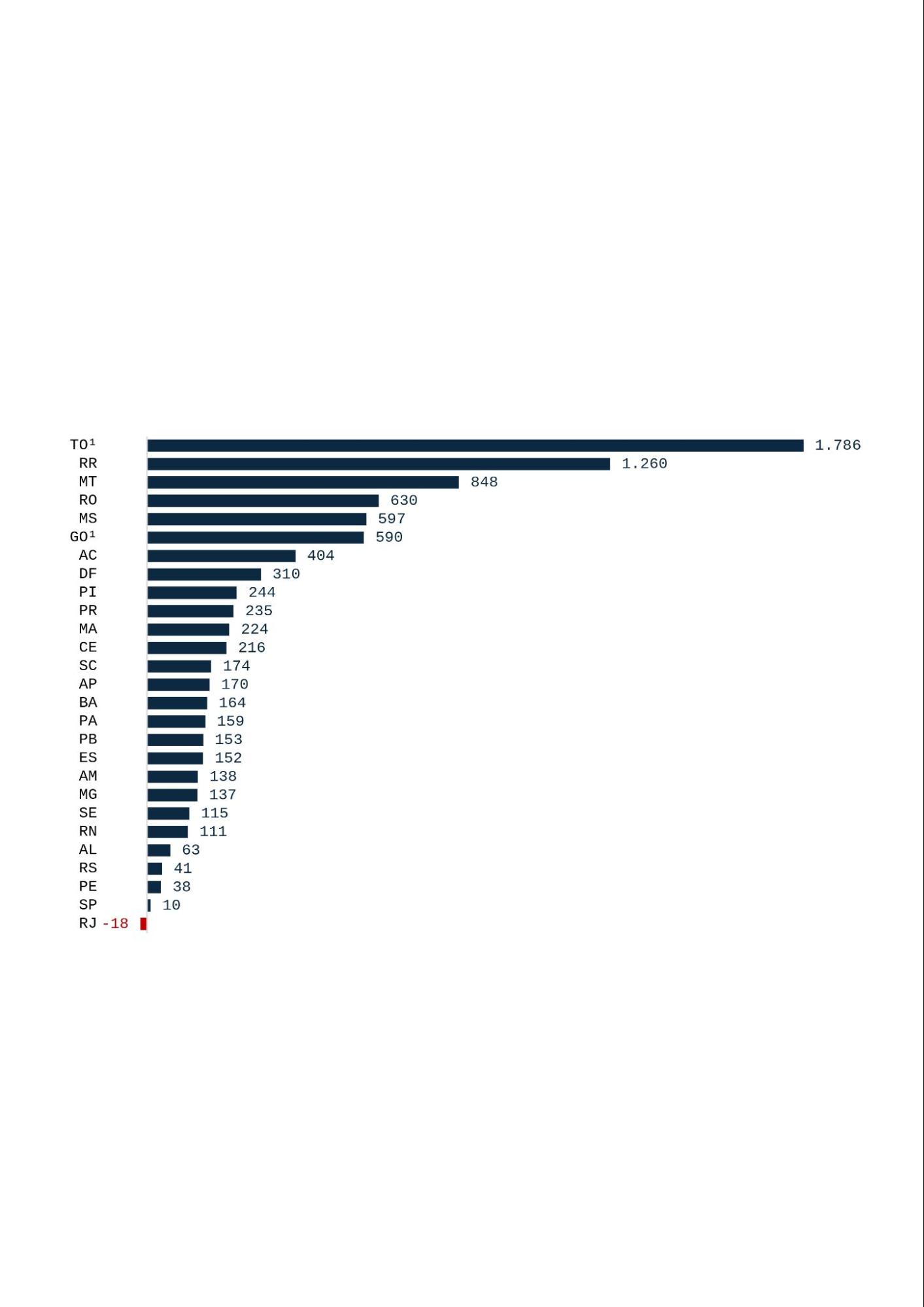

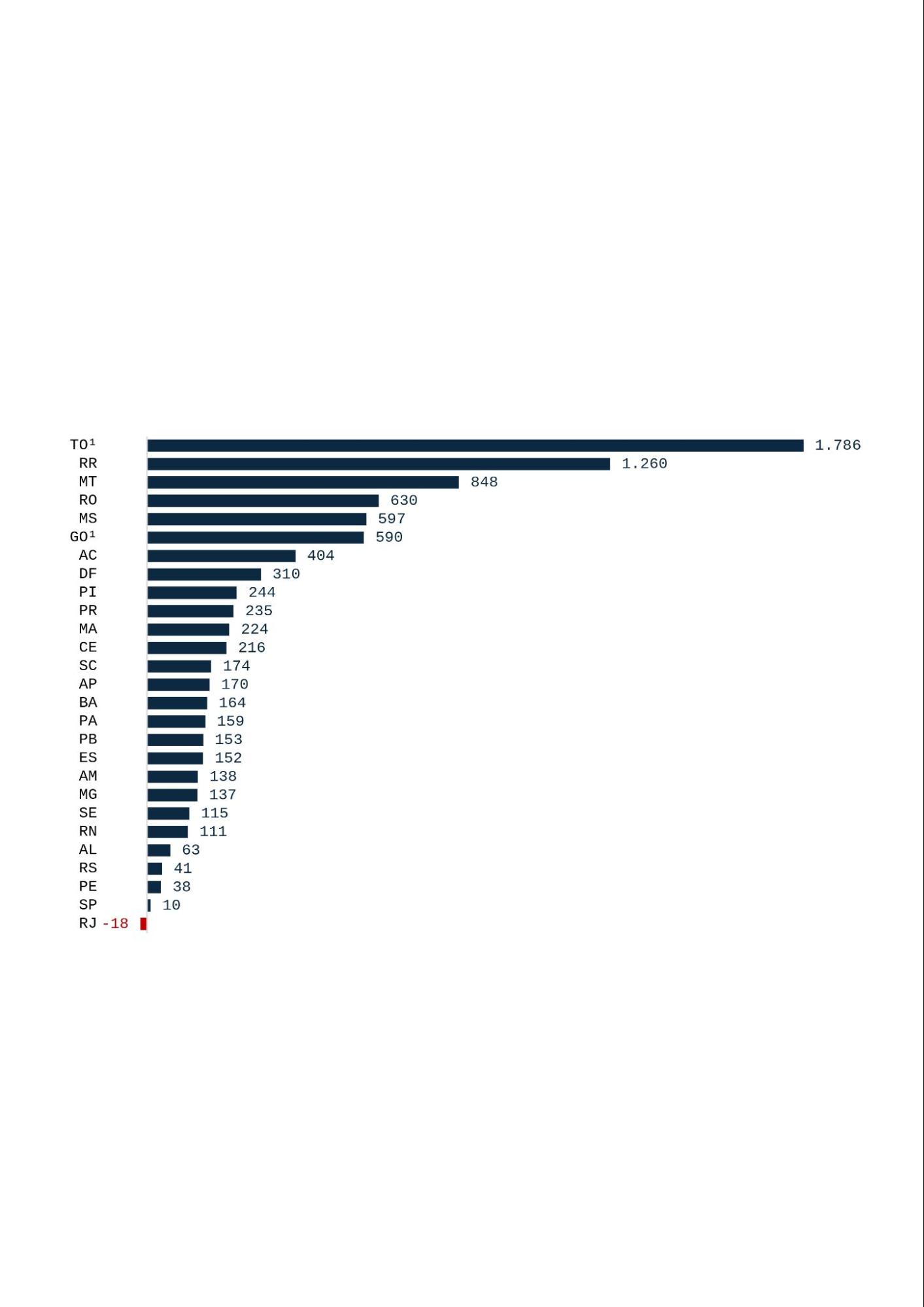

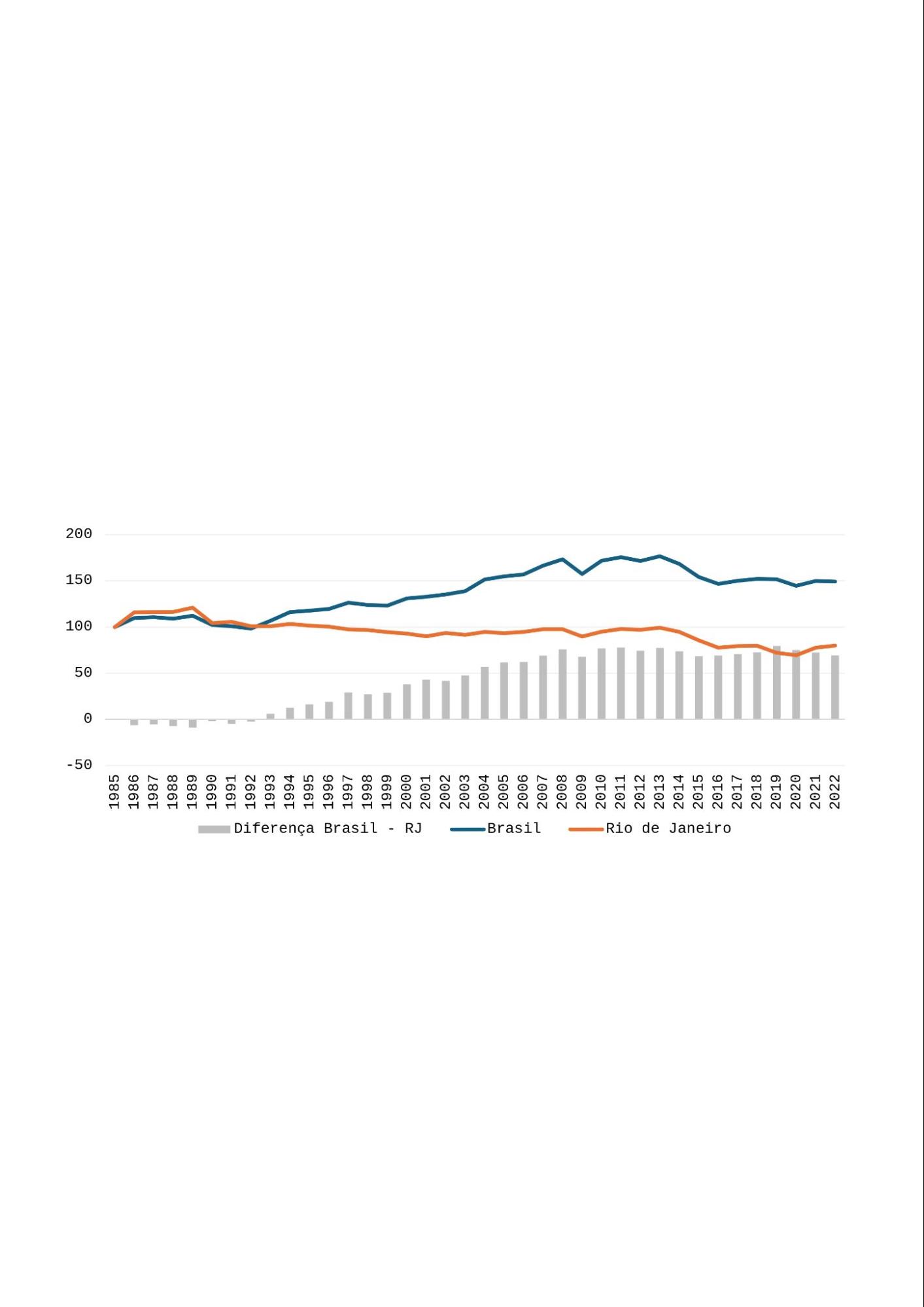

In Table 2, the negative performance of the value added of the transformation industry in Rio de Janeiro between 1985 and 2022 stands out, having been the only state in the country to have a real contraction in this activity in the period (-20.2%). In the analysis of formal employment links, Rio de Janeiro was also the only state to record a contraction, between 1985 and 2024, according to RAIS data. In this period, the contraction of formal employment in the fluminense activity was 18%, while in Brazil there was growth of 65.1%. Figure 1 presents the variation rates for all Brazilian states.

Figure 1: Variation Rate of Formal Employment Links in Transformation by State, between 1985 and 2024 - %[5]

Source: Annual List of Social Information - MTE. Own elaboration.

The transformation industry has a great capacity to generate positive externalities, by fostering both the supplier value chain (increased demand for products from agriculture and extractive industries, to be transformed) and the demand chain (increased demand for services such as trade of manufactured products, transportation to final consumers, financial intermediation for acquisition, among others), which makes it an important driver of economic growth, and can be considered an engine of economic growth (Squeff, 2012). For this reason, it is important to understand the characteristics of the deterioration of this activity in Rio de Janeiro.

- Evolution of the Fluminense Transformation Industry by Segment

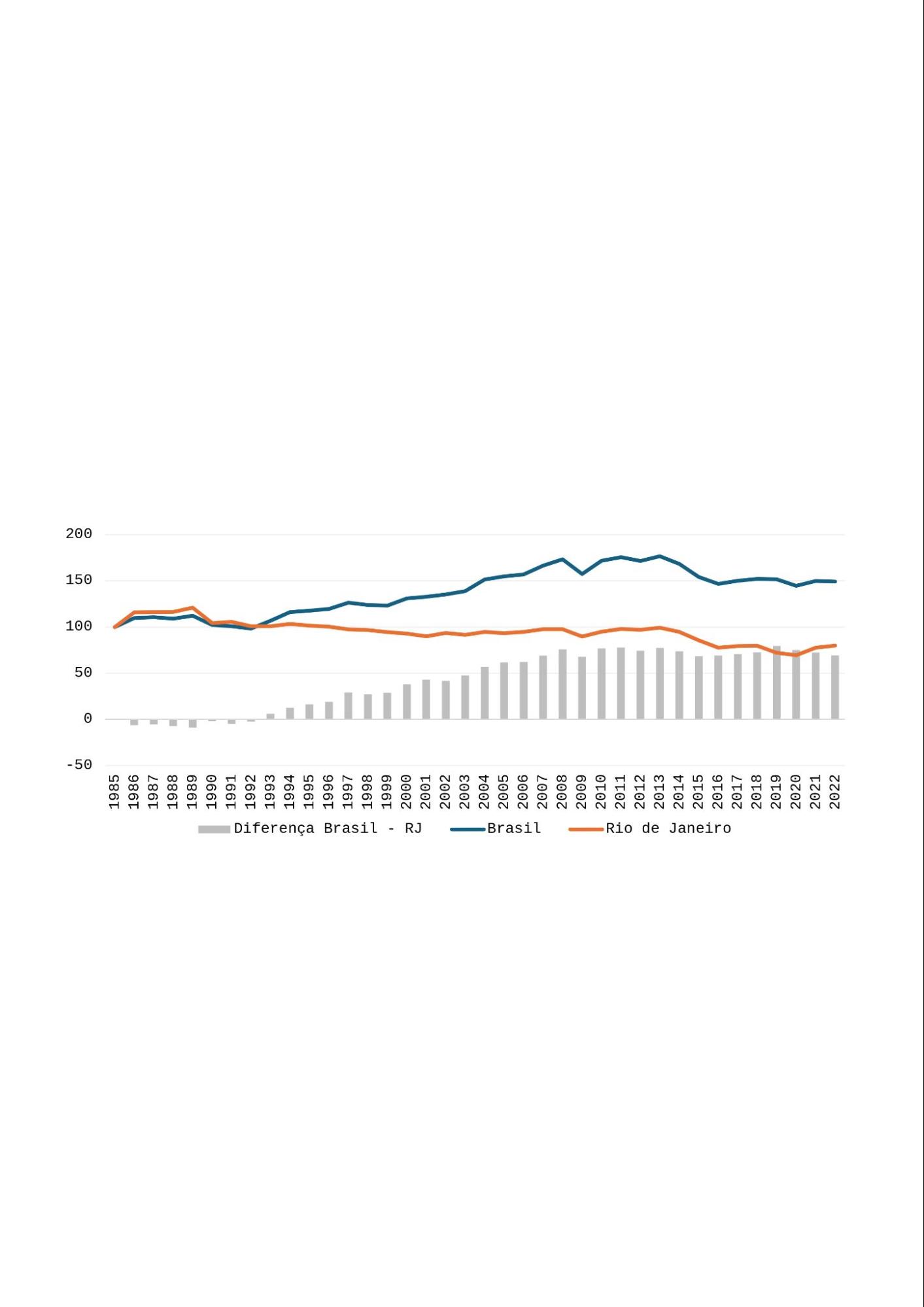

Figure 2 shows the real evolution of the value added of the transformation industry in Brazil and Rio de Janeiro between 1985 and 2022. It is noted that the decoupling of the state's activity from the national one began in 1993 and intensified until 2008, after which the evolution was similar in both locations.

Figure 2: Real Evolution of Value Added in the Transformation Industry of Brazil and Rio de Janeiro – 1985 = 100

Source: IBGE - Regional Accounts System. Own elaboration.

Based on data from the IBGE's Annual Industrial Survey (PIA), the accumulated real variation rates of the gross production value of the transformation industry in twenty segments between 1996 and 2022 were analyzed, presented in Table 3. Positive variations are highlighted in green, and negative ones in red.

Table 3: Real Variation of the Gross Production Value of the Transformation Industry and its Segments in Rio de Janeiro, between 1996 and 2022 - %

Segments | Rates - % |

Manufacture of motor vehicles, trailers and bodies | 1.358,1 |

Manufacture of coke, refined petroleum products and biofuels | 772,4 |

Metallurgy | 197,1 |

Manufacture of rubber and plastic products | 117,9 |

Other machinery and equipment | 67,7 |

Manufacture of furniture | 38,6 |

Manufacture of non-metallic mineral products | 32,8 |

Manufacture of beverages | 25 |

Manufacture of metal products, except machinery and equipment | 15,4 |

Manufacture of chemicals | 12,5 |

Manufacture of food products | -3 |

Manufacture of pulp, paper and paper products | -5,3 |

Manufacture of wearing apparel and accessories | -8,7 |

Manufacture of electrical machines, apparatus and materials | -11,4 |

Manufacture of pharmaceutical chemicals and pharmaceuticals | -47,1 |

Tanning, dressing and manufacture of leather, travel articles, handbags and footwear | -53,6 |

Manufacture of tobacco products | -60,6 |

Manufacture of wood products | -62 |

Manufacture of textiles | -65,2 |

Printing and reproduction of recorded media | -82,9 |

Source: IBGE - Annual Industrial Survey. Own elaboration.

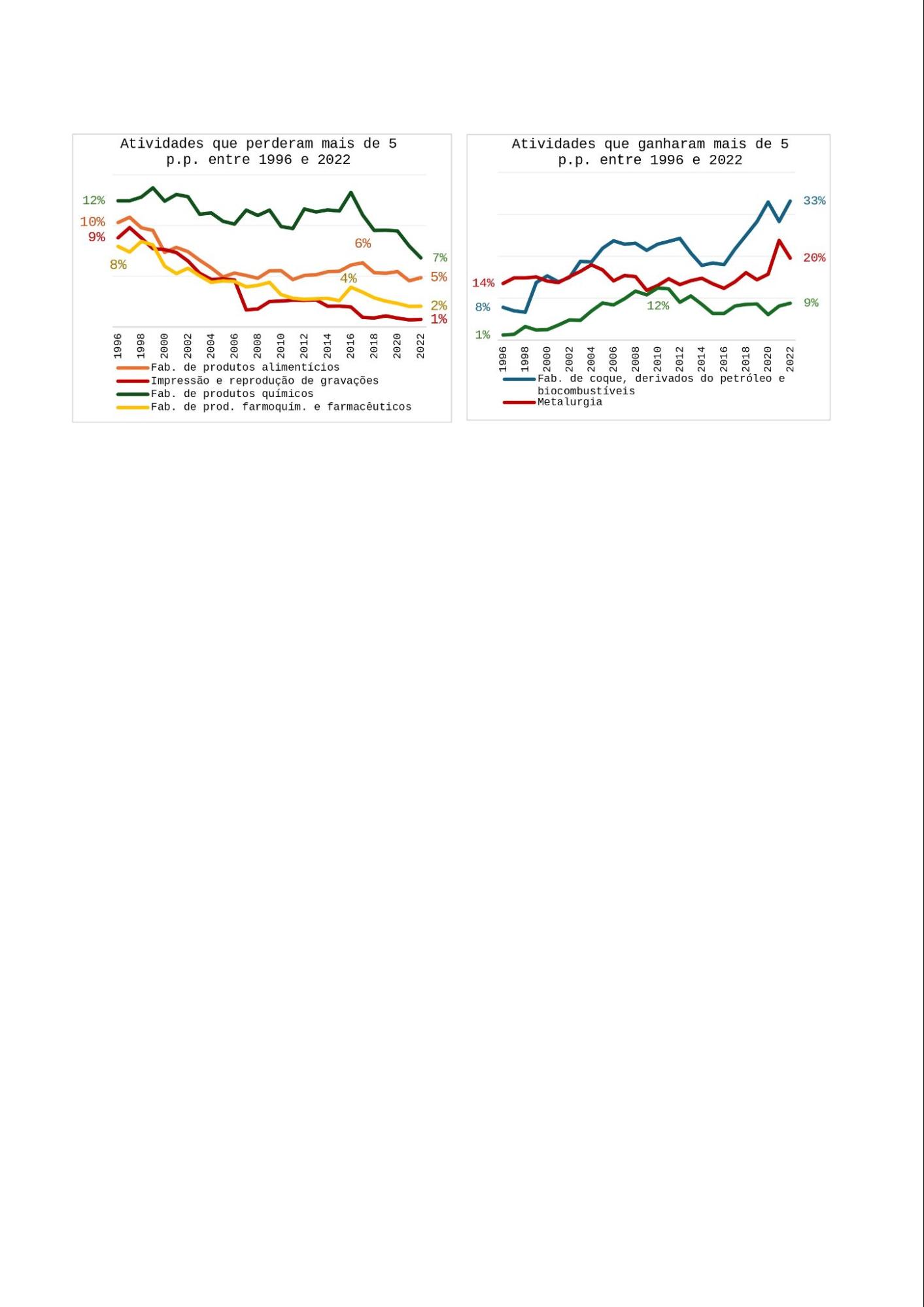

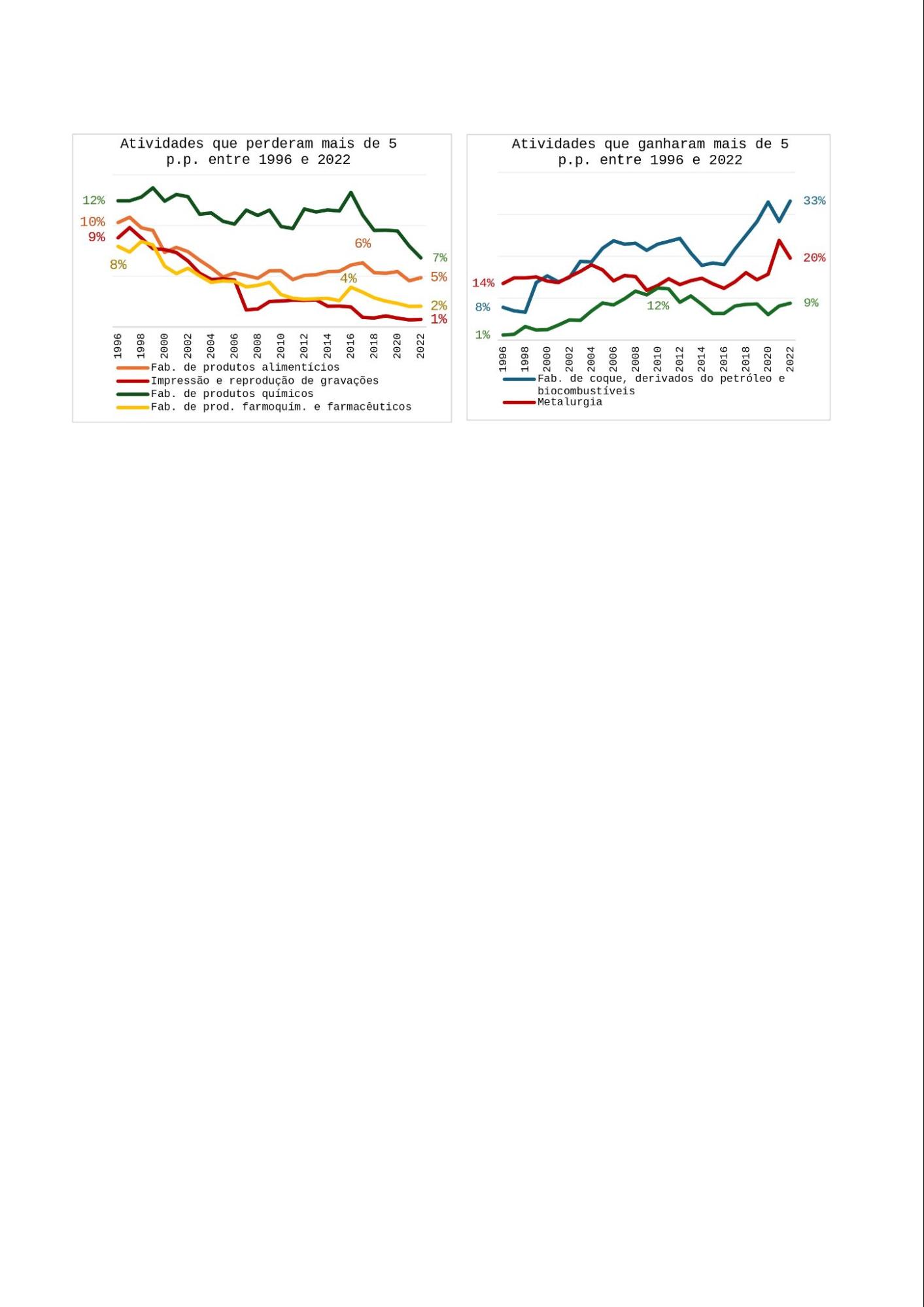

Between 1996 and 2022, four segments lost more than 5 percentage points (p.p.) of participation, while another three gained more than 5 p.p. of participation. In the other thirteen segments analyzed, although there were no individual changes in participation as intense, together they summed a loss of 13.9 p.p. in the period.

In Figure 3, the evolution of the participation shares of the segments that had increases or losses greater than 5 p.p. in the gross production value of the fluminense transformation industry between 1996 and 2022 are presented. On the left are the segments that lost participation, while on the right are the trajectories of the segments that increased it.

Figure 3: Evolution of the Participation Share of the Largest Changes in the Gross Production Value of Segments in Rio de Janeiro's Transformation Industry between 1996 and 2022 - %

Source: IBGE - Annual Industrial Survey. Own elaboration.

It is observed that there was a restructuring in the composition of the gross production value of the fluminense transformation industry over time, with an increase in concentration in only three segments: (i) manufacture of coke, refined petroleum products and biofuels, (ii) metallurgy, and (iii) manufacture of motor vehicles, trailers and bodies.

- Evolution of the Fluminense Transformation Industry by State Regions

The analysis by regions shows that the contraction in formal transformation employment was concentrated in the metropolitan region, specifically in the municipality of Rio de Janeiro. Table 4 presents the variation rates of formal transformation employment by regions of the state between 1985 and 2022.

Table 4: Variation of Formal Transformation Employment, between 1985 and 2022, by Different Locations – in %

Locations | Rates - % |

Brazil | 65,1 |

State of Rio de Janeiro | -18 |

Coastal Lowlands (Baixadas Litorâneas) | 249,7 |

South-Central Fluminense | 10,7 |

Costa Verde | 71,4 |

Médio Paraíba | 25,4 |

Metropolitan Area | -36,5 |

City of Rio de Janeiro | -51,1 |

Other cities | 8,5 |

Northwestern Fluminense | 153,8 |

Northern Fluminense | 81,9 |

Mountain Region | 63,2 |

Other states | 74,3 |

Source: MTE - RAIS. Own elaboration.

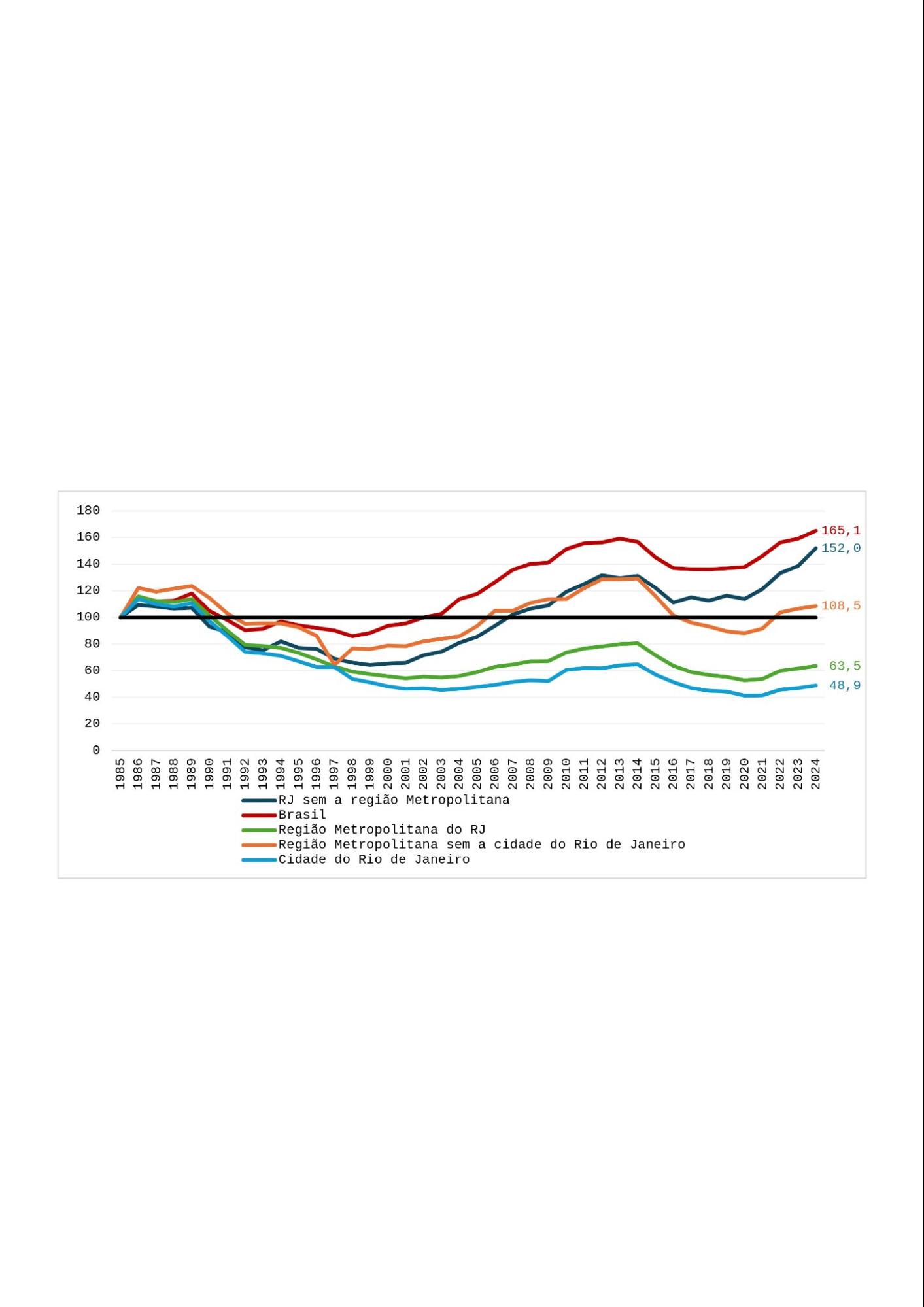

Between 1985 and 2024, the state, which is composed of eight regions, showed growth in formal transformation employment in seven, with the only contraction being in the metropolitan region (-36.5%). This region is composed of 19 municipalities[6], the largest of which, in population terms, is the city of Rio de Janeiro. The performance of formal transformation jobs in this municipality is the main factor explaining the contraction observed in the region, since the aggregate formal transformation employment in the other municipalities of the region grew by 8% in the period, while in the state capital, there was a reduction of 51.1%.

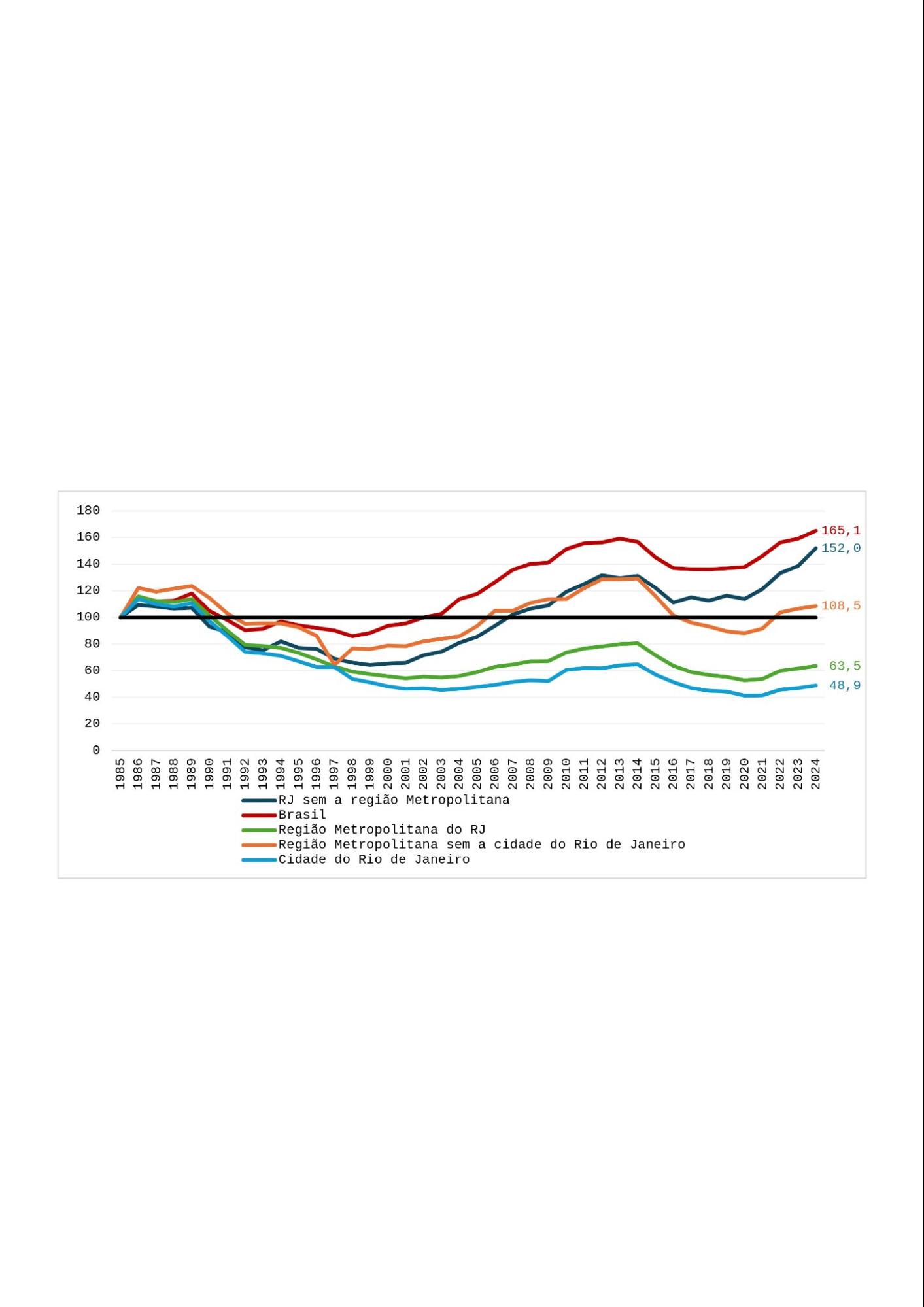

Figure 4 shows the evolution of formal transformation employment in Brazil and Rio de Janeiro, with exercises showing how much the contraction observed in the state is highly concentrated geographically in its capital.

Figure 4: Evolution of Formal Transformation Employment by Location - 1985=100

Source: MTE - RAIS. Own elaboration.

Only the city of Rio de Janeiro and the metropolitan region performed worse in 2024 than they did in 1985. Since the performance of the city of Rio de Janeiro was the main responsible for the drop in formal transformation employment in the state, the following section analyzes the evolution of the transformation industry, in this city, by segments.

- Evolution of the Transformation Industry in the City of Rio de Janeiro by Segments

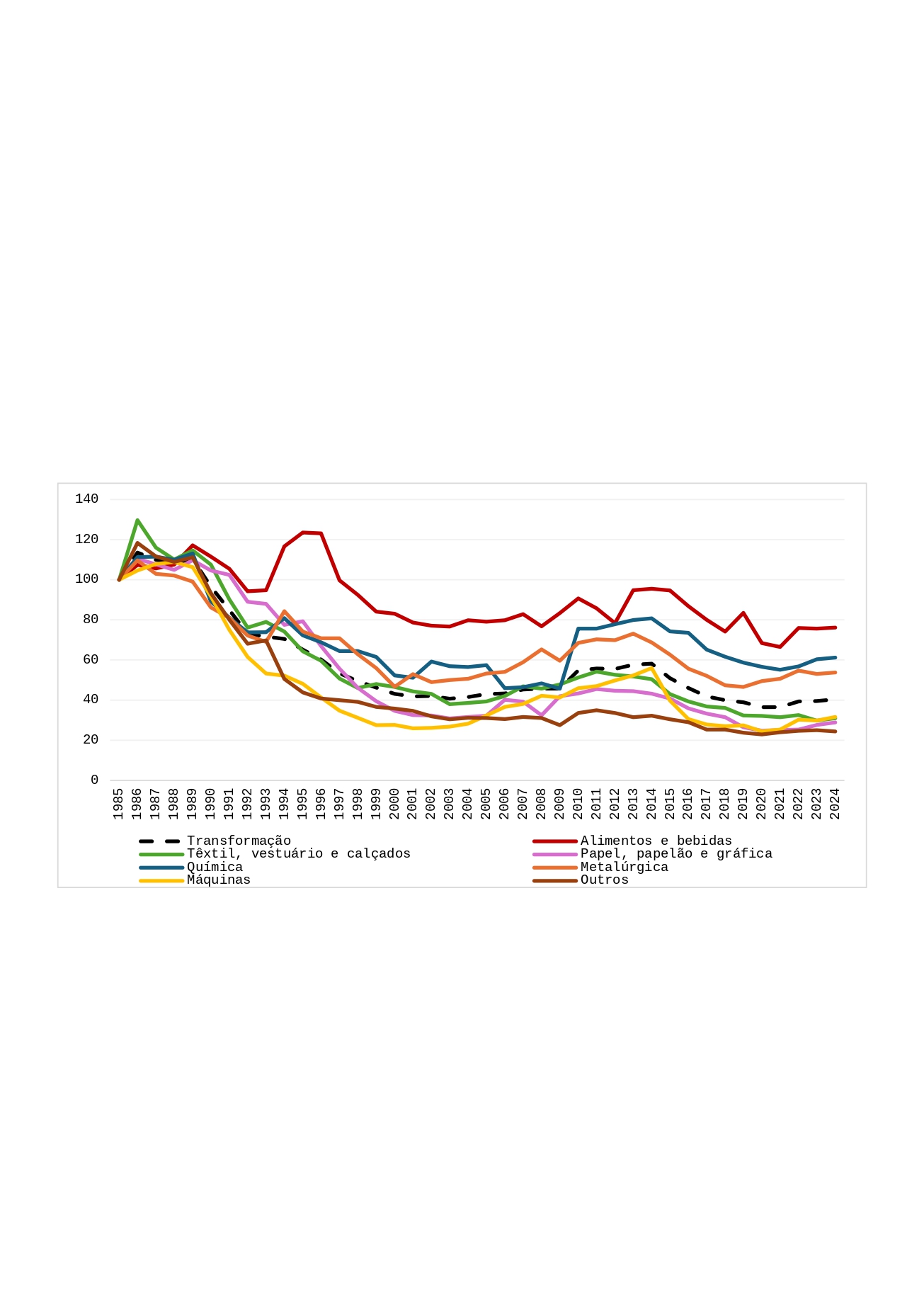

In the disaggregated analysis by segments, presented in Table 5, it is observed that the contraction of formal transformation jobs in the municipality of Rio de Janeiro between 1985 and 2024 was widespread, with contractions above 20% in all segments analyzed.

Table 5: Variation of Formal Jobs by Segments of the Transformation Industry in the City of Rio de Janeiro between 1985 and 2024 - %

Segments | Municipality of Rio de Janeiro |

Transformation | -59,6 |

Food and beverages | -23,8 |

Textiles, apparel and footwear | -69,0 |

Paper, cardboard and printing | -71,2 |

Chemicals | -38,8 |

Metallurgy | -46,3 |

Machinery | -68,4 |

Other | -75,6 |

Source: MTE - RAIS. Own elaboration.

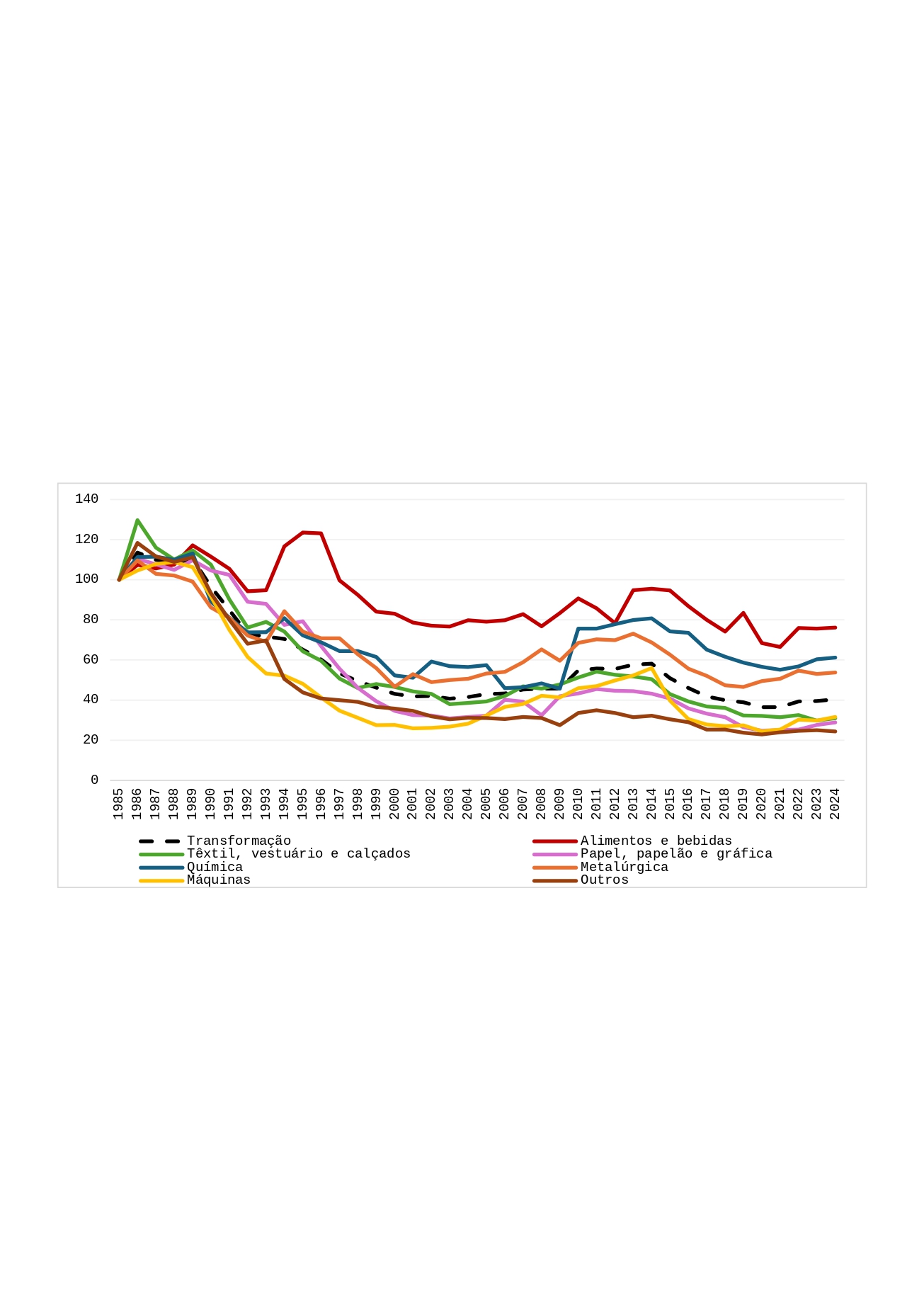

As illustrated in Figure 5, which shows the evolution trajectories of formal employment by segments of the transformation industry in the city of Rio de Janeiro since 1985, most of this contraction occurred in the 1990s, a period in which only the food and beverage manufacturing segment showed growth in formal employment in the city. However, by the end of the 1990s, this segment also contracted in the city, as happened with the others.

Figure 5: Evolution of Formal Transformation Employment in the City of Rio de Janeiro by Segments - 1985=100

Source: MTE - RAIS. Own elaboration.

In the analysis starting from 1994, it was possible to increase the granularity of the investigated segments from seven to 18. It is noteworthy that between 1994 and 2024, there was a contraction of 39.4% in formal transformation jobs in the city, with contraction in 17 segments. In this period, only the manufacture of coke, refined petroleum products and biofuels showed growth in formal employment in the city, and this was quite significant (1,394.4%).

These results show that the deterioration of the transformation industry in the city of Rio de Janeiro was practically widespread, which contributed to deindustrialization in the city, with a reduction in economic diversification so acute that it influenced the economic performance of the entire state.

- Rio de Janeiro’s deindustrialization

The deindustrialization process is observed when there is a loss of participation of the transformation industry in the economy. It can be considered problematic if this process occurs prematurely, due to deficiencies in industrial development, with effects of reducing long-term potential economic growth (Morceiro, 2011).

Given the contraction of the transformation industry in Rio de Janeiro, both in terms of value added and the generation of formal jobs, the prematurity of fluminense deindustrialization is undeniable. The transformation industry in the state showed the worst evolution in the country, with a significant influence of its capital's performance on this pattern.

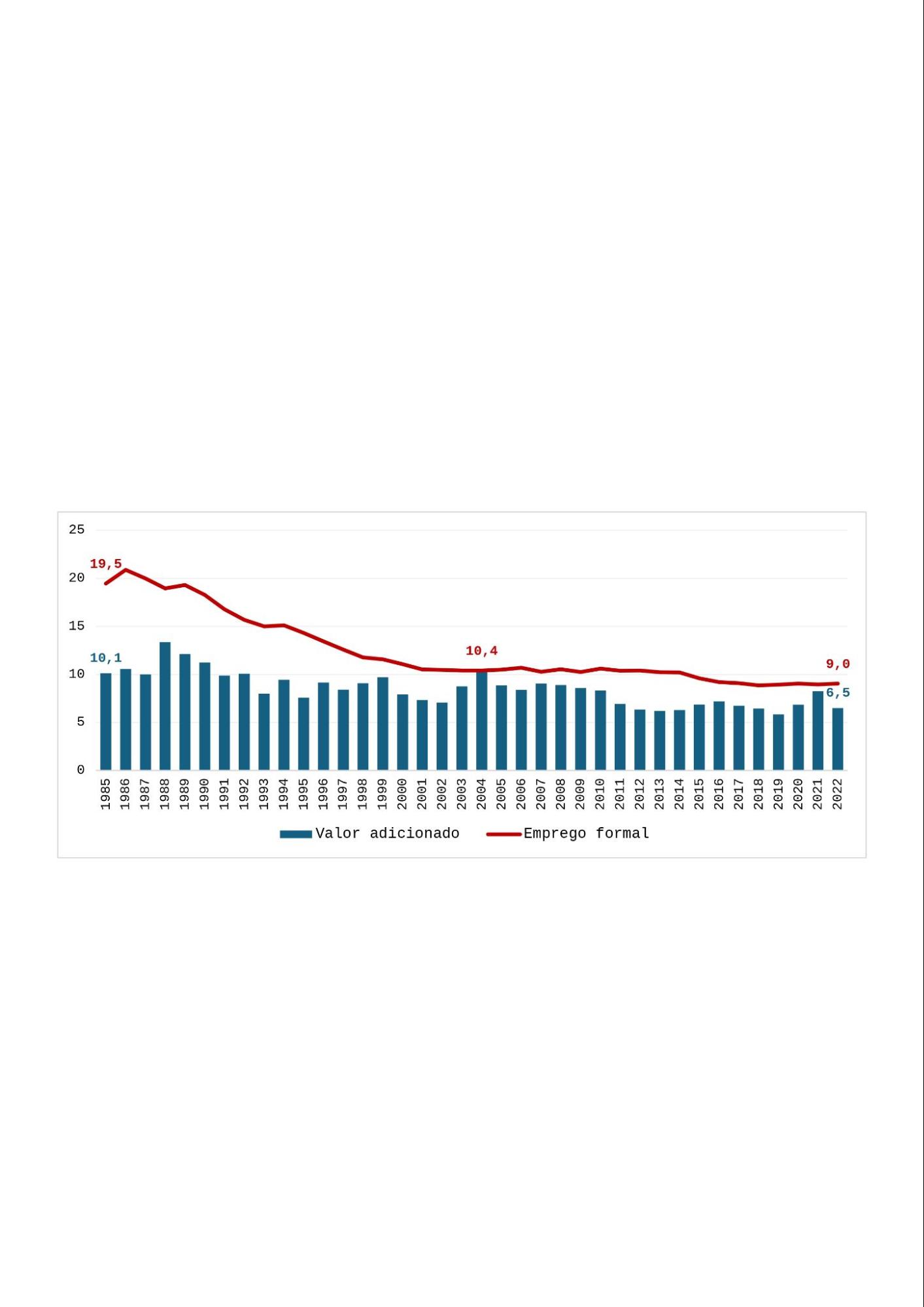

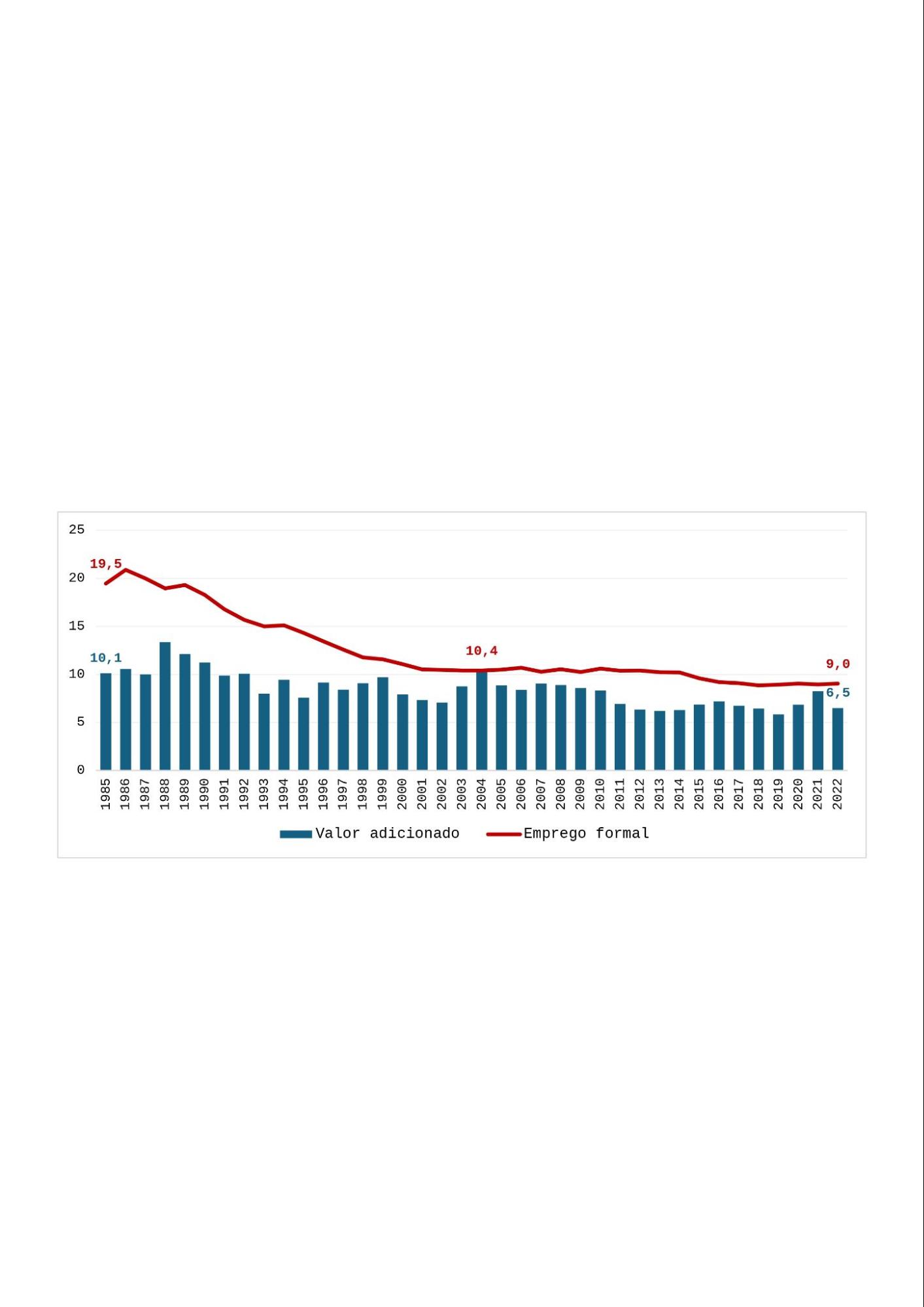

Figure 6 shows the participation of the transformation industry in the fluminense economy, measured by value added and formal employment. Evident deindustrialization in the state is noted in both metrics analyzed.

Figure 6: Participation of Transformation Industry Value Added and Formal Employment in the Total of These Variables in the Fluminense Economy - %

Source: IBGE - Regional Accounts System. Own elaboration.

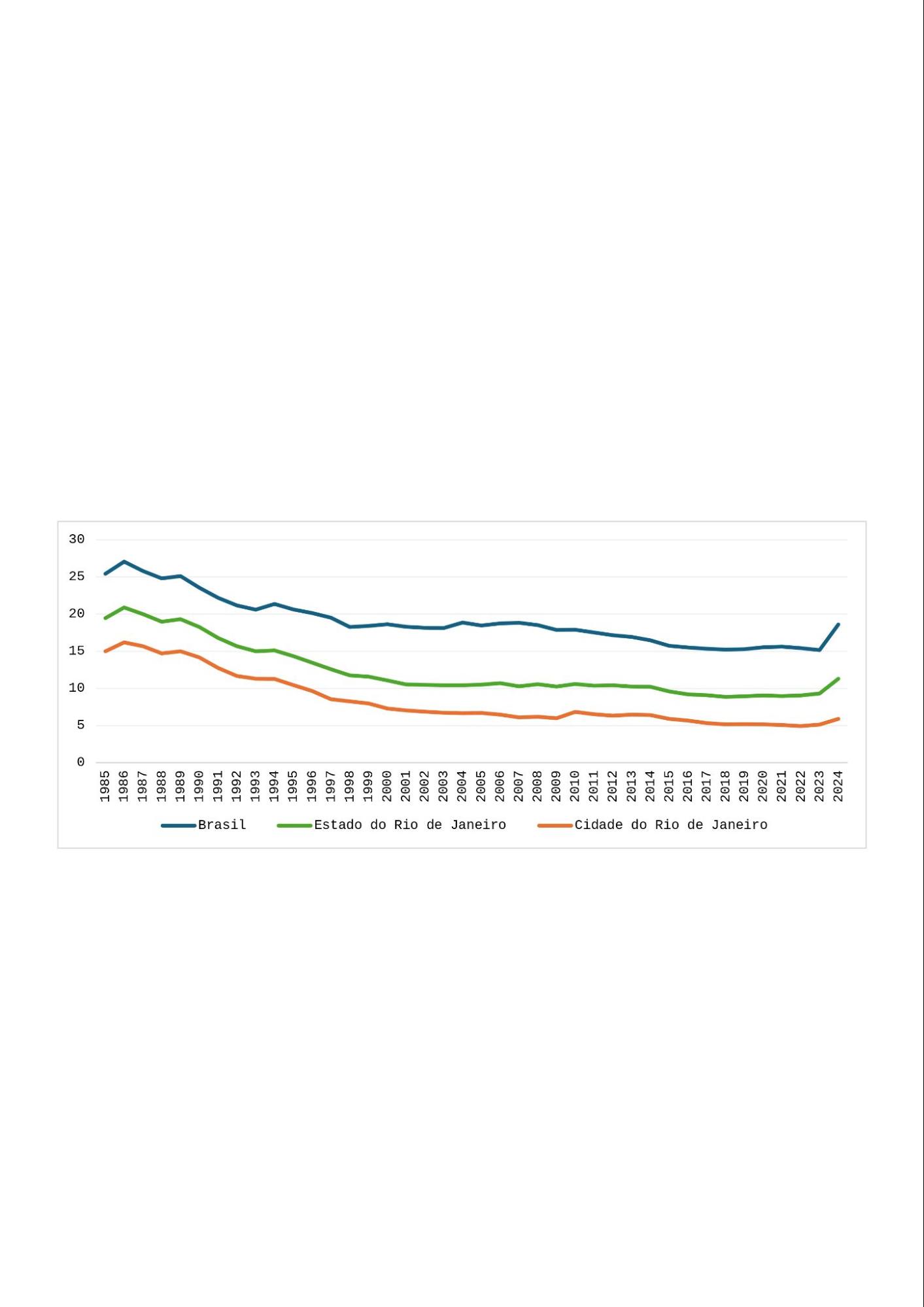

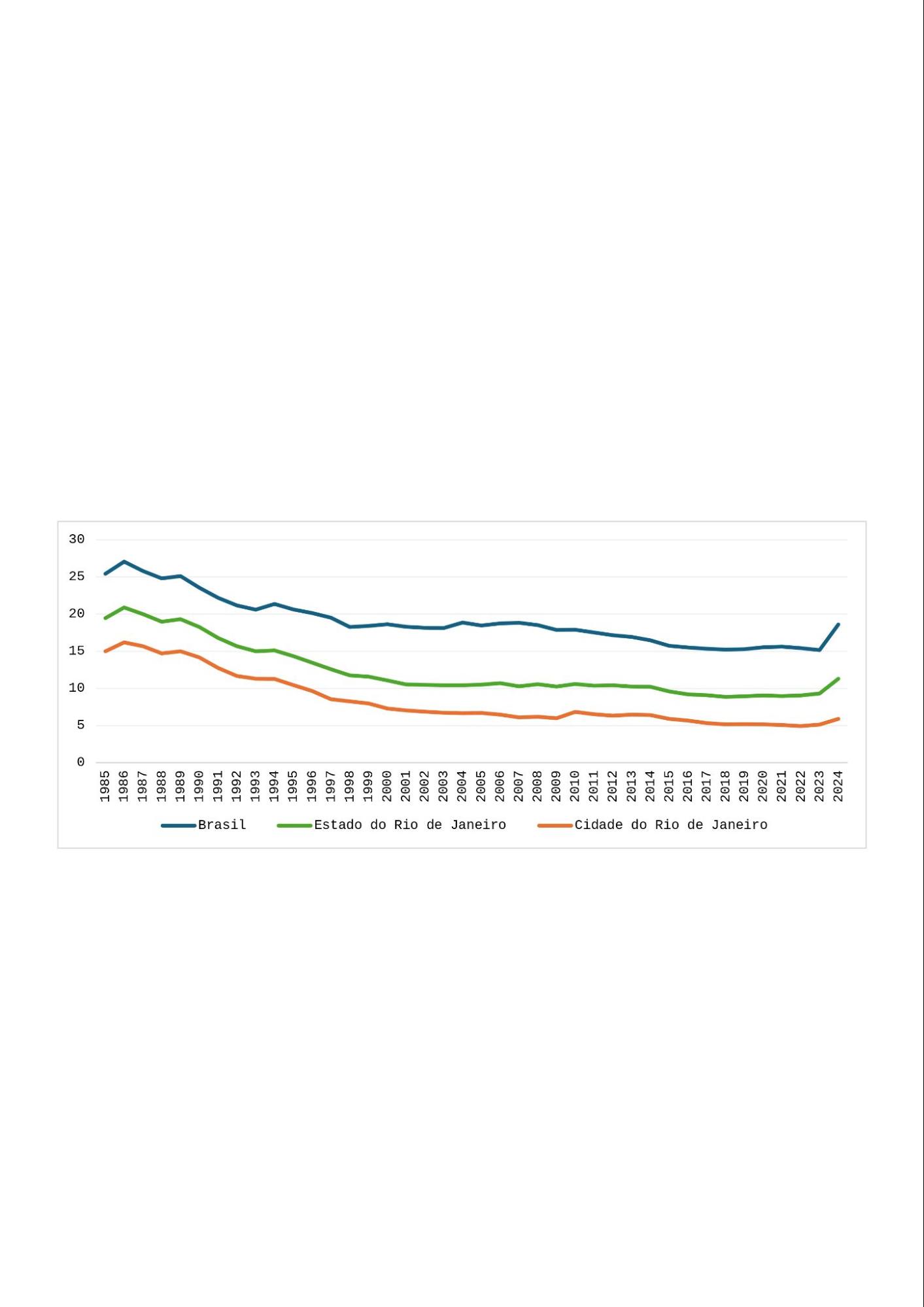

In Figure 7, the participation of the transformation industry in the economy by regions, measured by formal employment, is presented.

Figure 7: Participation of Formal Transformation Employment in Total Employment by Location - %

Source: MTE – RAIS. Own elaboration.

It is noted that, structurally, Brazil has a greater representativeness of the transformation industry in the economy than the state of Rio de Janeiro, which, in turn, is more significant at the national level than in the municipality of Rio de Janeiro. In terms of evolution, all three locations underwent deindustrialization over time. The transformation industry, in all these locations, faced challenges such as economic opening, fiscal crises, and changes in industrial policy, which impacts industrial employment. However, in the 2000s, there was a stabilization of the transformation industry's participation in the national economy, while in the state and city of Rio de Janeiro, deindustrialization proved to be continuous, which may indicate that local economic and political factors contributed to a greater intensification of fluminense deindustrialization.

- Energy Transition and the Reindustrialization Opportunity

The presented results show that, over time, Rio de Janeiro has faced widespread challenges in the transformation industry. The main segment of the activity that stands out in the state is the manufacture of coke, refined petroleum products and biofuels. This is explained by the fact that the state is the main producer of oil and natural gas in the country.

There are various economic problems inherent in intensifying the concentration of the economy, as this increases the risks of economic dependence. In Rio de Janeiro, a clear concentration in the oil chain is noted, from the extractive activity, which stands out as the one with the highest growth in the state, to the refinery, which although part of the transformation industry, is highly associated with the good performance of the extractive industry.

There is increasing evidence that the oil industry must reformulate itself throughout the 21st century. This is explained by the need to reduce the consumption of fossil fuels to combat the intensification of global warming, which has contributed to the increased occurrence of adverse consequences for humanity, such as increased chances of storms, floods, famine, migration, among others (IPCC, 2021). One of the main measures to combat the intensification of climate change is the energy transition, whose objective is to expand the gradual use of renewable and clean energies, to the detriment of the use of fossil fuels, such as oil and its derivatives and mineral coal, for example.

This context brings enormous challenges to the economic structure of Rio de Janeiro, which is highly dependent on oil production. There is a need to diversify the productive structure of Rio de Janeiro because, otherwise, the expected reduction in demand for oil throughout the century could contribute to the creation of a new economic void in the state, like the one experienced after the federal capital's departure from the city of Rio de Janeiro and the unification of Guanabara with the state. It is necessary to expand development in activities related to research and development, artificial intelligence, the transformation industry, the technology sector, and low-carbon activities, a movement similar to that undertaken in countries with a significant productive structure for oil production (Yu Iii, 2022).

Despite being a challenge for Rio de Janeiro, the energy transition can also be an opportunity for its reindustrialization. The state, in addition to its oil profile, has the potential for the development of other activities in the energy sector associated with low-carbon activities, such as offshore wind power generation and green hydrogen production (FIRJAN, 2024). Rio de Janeiro is one of the states with the greatest potential for offshore wind generation in the country, according to the Energy Research Company - EPE (2020). Furthermore, the experience acquired in the production of oil and natural gas in an offshore environment brings an advantage for the development of activities in the state that are in this environment due to the existence of already developed naval infrastructure (FIRJAN, 2024).

In addition to the direct effects these activities can generate in the economy, they also have the capacity to foster the development of a local productive chain, such as, for example, the development of wind turbine manufacturing, or the use of green hydrogen for the production of green steel (CNI, 2023). It is noted, therefore, that these are examples of potential expansion activities that can strengthen Rio de Janeiro's industry and contribute to the diversification of its economy.

In this sense, taking advantage of the opportunities generated by the energy transition can contribute to making Rio de Janeiro's productive structure diversified, with a greater industrial presence, and consequently, more resilient than the currently fragile one.

For this, however, one must first seek the stabilization of Rio de Janeiro's troubled political environment by signaling that the state's objective is to foster the economy, together with plans for: fiscal stabilization, public security, the fight against corruption, and the provision of quality public services to the population.

- Final Considerations

This article sought to relate the fluminense deindustrialization process with the political context of the state's formation. The objective was to show that the state's current economic results reflect past choices, where there was an absence of implementation of a regional economic development plan for Rio de Janeiro. Consequently, in recent decades, the state's economic performance has been widespread and stands out as one of the worst in the country, with emphasis on the deterioration of the transformation industry, a crucial activity for economic development.

This result is a reflection of multiple factors experienced by the state over the last century, such as high political tension, corruption cases, increased crime, precarious provision of public services, unemployment, among others, generating a combination of crises that reinforced each other. In all these cases, a lack of prioritization of local interests, of the fluminense population, in favor of national interests, oriented outside the sphere of the fluminense population, is noted.

In this troubled context, the energy transition adds another challenge to a state with a productive structure dependent on oil production. However, it can be an alternative for the establishment of an effective regional development planning that encourages the emergence of a productive chain associated with low-carbon activities and, thereby, favors economic diversification in Rio de Janeiro.

The history of Rio de Janeiro's economy up to this point does not define its future. It is important to understand the factors that led the state to achieve the current results so that they can be modified towards a more prosperous trajectory. The first step to foster development must be the pursuit of stabilization of the political environment so that, then, the economic environment can be stimulated.

Additionally, regional planning must be carried out. Although it is not trivial, there is a need to gradually foster the restructuring of the fluminense economy. Rio de Janeiro is not doomed to failure, but a change of course is necessary, beginning with the strengthening of political institutions, so that society can develop in multiple aspects and create the conditions for a more developed Rio de Janeiro.

References

CEBALLOS, V. “E a história se fez cidade...”: a construção histórica e historiográfica de Brasília. Master’s Dissertation, Universidade Estadual de Campinas, Campinas, SP, 2005. Available at: https://cpdoc.fgv.br/sites/default/files/brasilia/trabalhos/OCR_CEBALLOS.pdf

CEPERJ. Cartografia fluminense – Estado do Rio de Janeiro - Regiões de Governo e Municípios – 2019.

CONFEDERAÇÃO NACIONAL DA INDÚSTRIA (CNI). Oportunidades e Desafios para Geração Eólica Offshore no Brasil e a Produção de Hidrogênio de Baixo Carbono, 2023. Available at: https://static.portaldaindustria.com.br/media/filer_public/2a/61/2a61a6a8-abf5-4eea-8328-865725c995a4/id_243190_oportunidades_e_desafios_para_geracao_eolica_web.pdf

COSTA, P. O esvaziamento Econômico do Rio de Janeiro e a perda da capitalidade, Trabalho de conclusão de graduação, UFRJ, 2010. Available at: https://pantheon.ufrj.br/handle/11422/2338

EPE. Roadmap Eólica Offshore Brasil – Perspectivas e caminhos para a energia eólica marítima, 2020. Available at: https://www.epe.gov.br/pt/publicacoes-dados-abertos/publicacoes/roadmap-eolica-offshore-brasil

FERREIRA, M. A fusão do Rio de Janeiro, a ditadura militar e a transição política. In: ABREU, A. A. (Org.). A democratização no Brasil: atores e contextos. Rio de Janeiro: FGV, 2006. cap. 6, p. 163 - 203. Available at: https://repositorio.fgv.br/server/api/core/bitstreams/0cde57e1-93eb-4779-a148-4e7a971fcab7/content#:~:text=A%20fus%C3%A3o%20do%20estado%20da,nova%2C%20mas%20enfrentava%20resist%C3%AAncias%20variadas.

FERREIRA, U. As políticas de transportes urbanos e o Estado: um estudo sobre as relações do poder público com as empresas de transporte na Região Metropolitana do Rio de Janeiro. Master’s dissertation. IBGE, ENCE, 2018.

FIRJAN, Transição e integração energética no Rio, Versão Completa, Rio de Janeiro, 2024. Available at: https://www.firjan.com.br/data/files/C8/30/13/84/5DE21910682D1D09D8284EA8/2024_06_Transicao_Integracao_Energetica_Rio.pdf

IPCC, 2021: Summary for Policymakers. In: Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Masson-Delmotte, V., P. Zhai, A. Pirani, S.L. Connors, C. Péan, S. Berger, N. Caud, Y. Chen, L. Goldfarb, M.I. Gomis, M. Huang, K. Leitzell, E. Lonnoy, J.B.R. Matthews, T.K. Maycock, T. Waterfield, O. Yelekçi, R. Yu, and B. Zhou (eds.)]. In Press. Available at: https://www.ipcc.ch/report/ar6/wg1/downloads/report/IPCC_AR6_WGI_SPM.pdf

MARTÍN, M. Rio de Janeiro, da euforia à depressão, El País, 2016. Available at: https://brasil.elpais.com/brasil/2016/11/10/politica/1478799785_114849.html

MORCEIRO, Paulo César. Desindustrialização na economia brasileira no período 2000-2011: abordagens e indicadores. São Paulo: Cultura Acadêmica, 2012. (Coleção PROPG Digital - UNESP). ISBN 9788579833717.

MOTTA, Marly Silva da. A fusão da Guanabara com o Estado do Rio: desafios e desencantos. In: UM ESTADO em questão: os 25 anos do Rio de Janeiro/ Organizadores: Américo Freire, Carlos Eduardo Sarmento, Marly Silva da Motta. Rio de Janeiro: Ed. Fundação Getulio Vargas, 2001. p.19-56. Available at: https://repositorio.fgv.br/server/api/core/bitstreams/620b4951-cba6-4f8b-8b21-b07aa25703d1/content

OSÓRIO, M. e VERSIANI, M. H. História da Capitalidade do Rio de Janeiro. Cadernos do Desenvolvimento Fluminense, nº 10, 2015. Available at: https://www.e-publicacoes.uerj.br/index.php/cdf/article/view/19711/15986

PEDREIRA, P.; BRANDÃO., R; FREITAS FILHO, A. A historiografia da industrialização fluminense - A renovação recente dos estudos sobre o desenvolvimento fabril no estado do Rio de Janeiro nos séculos XIX e XX. Acervo, [N. p.], v. 37, n. 2, p. 1–24, 2024. Available at: https://revista.an.gov.br/index.php/revistaacervo/article/view/2156/2023

PORTAL MULTIRIO, O Rio de Janeiro é o presente. Available at: https://multirio.rio.rj.gov.br/index.php/historia-do-brasil/rio-de-janeiro/3367-e-o-presente

RIBEIRO, A.; AZEVEDO NETO, J. A crise econômica do estado do Rio de Janeiro e os possíveis caminhos de concertação. Petróleo, Royalties e Região, v. 23, n. 1, 2024. Available at: https://boletimpetroleoroyaltieseregiao.ucam-campos.br/index.php/bprr/article/view/177.

SOBRAL, B. A evidência da estrutura produtiva oca: O Estado do Rio de Janeiro como um dos epicentros da desindustrialização nacional. Em: MONTEIRO NETO, A.; CASTRO, C.; BRANDÃO, C. (org.). Desenvolvimento regional no Brasil: políticas, estratégias e perspectivas. Rio de Janeiro, 2017, Ipea, pp. 397-426. Available at: https://repositorio.ipea.gov.br/handle/11058/9057

SOUZA, L. e SGARBI, G. Bacia de Santos no Brasil: geologia, exploração e produção de petróleo e gás natural. Boletín de Geología, vol.41 no.1 Bucaramanga Jan./Apr., 2019. Available at: http://www.scielo.org.co/scielo.php?pid=S0120-02832019000100175&script=sci_arttext&tlng=pt

SQUEFF, G. Desindustrialização, luzes e sombras no debate brasileiro. Brasília: Ipea, 2012. (Texto para Discussão, n. 1747). Disponível em: https://repositorio.ipea.gov.br/handle/11058/1125

VIEIRA, W. A decadência da cafeicultura fluminense e seus efeitos na diversificação agrícola da região (1889-1930). Leituras de Economia Política, volume 6, nº. 1 (8), p. 1-159, 2001. Available at: https://www.abphe.org.br/arquivos/wilson-vieira_3.pdf

YU III, V. Economic Diversification from Oil Dependency: Practice and Lessons from Persian Gulf Oil-Dependent Developing Countries. Third World Network, Climate Change Series 6, 2022. Available at: https://www.twn.my/title2/climate/series/cc06.pdf

About the Author

Juliana Trece holds a Ph.D. in Population, Territory and Public Statistics from the National School of Statistical Sciences (ENCE/IBGE), a Master's in Business Economics from the Brazilian School of Economics and Finance (FGV/EPGE), and a Bachelor's degree in Economics from the Fluminense Federal University (UFF). She is currently the coordinator of the National Accounts Unit at the Brazilian Institute of Economics (FGV IBRE).

Author Contributions

Conceptualization, J.C.C.T, Methodology, J.C.C.T, Software, J.C.C.T, Validation, J.C.C.T, Formal analysis, J.C.C.T, Investigation, J.C.C.T, Resources, J.C.C.T, Data curation, J.C.C.T, Writing—original draft preparation, J.C.C.T, Writing—review and editing, J.C.C.T, Visualization, J.C.C.T.

Conflicts of Interest

The author declares no conflicts of interest.

About Coleção Estudos Cariocas

Coleção Estudos Cariocas (ISSN 1984-7203) is a publication dedicated to studies and research on the Municipality of Rio de Janeiro, affiliated with the Pereira Passos Institute (IPP) of the Rio de Janeiro City Hall.

Its objective is to disseminate technical and scientific production on topics related to the city of Rio de Janeiro, as well as its metropolitan connections and its role in regional, national, and international contexts. The collection is open to all researchers (whether municipal employees or not) and covers a wide range of fields — provided they partially or fully address the spatial scope of the city of Rio de Janeiro.

Articles must also align with the Institute’s objectives, which are:

- to promote and coordinate public intervention in the city’s urban space;

- to provide and integrate the activities of the city’s geographic, cartographic, monographic, and statistical information systems;

- to support the establishment of basic guidelines for the city’s socioeconomic development.

Special emphasis will be given to the articulation of the articles with the city's economic development proposal. Thus, it is expected that the multidisciplinary articles submitted to the journal will address the urban development needs of Rio de Janeiro.

[1] The term “Fluminense” is used here as a descriptor for the geographical region corresponding to the state of Rio de Janeiro. It historically refers to the inhabitants, culture, and territorial identity of this state, distinguishing it from other regions of Brazil.

[2] Moreira Franco, Anthony Garotinho, Rosinha Garotinho, Sérgio Cabral, and Luiz Fernando Pezão were arrested. Wilson Witzel was removed from office and investigated.

[3] Squeff (2012) explains that Kaldor’s argument is based on the fact that the rapid increase in industrial productivity, as output grows, is due to the presence of economies of scale, which are quite common in this sector.

[4] Rowthorn initially proposed an analysis based on employment data. Later, Tregenna began to analyze value-added data (Morceiro, 2011).

[5] TO and GO were a single federative unit before 1989. The estimate for TO prior to 1989 was obtained based on the evolution of GO’s series. In turn, for this period, GO was calculated as the difference between the total for the state and the estimate for TO.

[6] According to CEPERJ (2019).