Volume 13 Issue 3 *Corresponding author naiaraecon@gmail.com Submitted 15 jul 2025 Accepted 25 jul 2025 Published 15 aug 2025 Citation CARVALHO, N. S., et al. Early deindustrialization: an analysis of the stock of formal jobs in the Rio de Janeiro manufacturing industry. Coleção Estudos Cariocas, v. 13, n. 3, 2025.

DOI: 10.71256/19847203.13.2.161.2025 The article was originally submitted in PORTUGUESE. Translations into other languages were reviewed and validated by the authors and the editorial team. Nevertheless, for the most accurate representation of the subject matter, readers are encouraged to consult the article in its original language.

| Early deindustrialization: an analysis of the stock of formal jobs in the Rio de Janeiro manufacturing industry Desindustrialização precoce: uma análise sobre o estoque de empregos formais da indústria de transformação carioca Desindustrialización temprana: un análisis del stock de empleos formales en la industria manufacturera de Río de Janeiro Naiara S. Carvalho1, Carlos A. O. Bernardo2, Larissa A. Oliveira3

and Ronald C.C. Guimarães Filho4 1 ONU-Habitat Brasil e Cone Sul: Rua Gago Coutinho, nº52, CEP: 22221-070. Laranjeiras, Rio de Janeiro - RJ – Brasil – https://orcid.org/0009-0002-0414-6165, naiaraecon@gmail.com; 2 Instituto Municipal de Urbanismo Pereira Passos - IPP: Rua Gago Coutinho, nº52, CEP: 22221-070. Laranjeiras, Rio de Janeiro – RJ – Brasil – https://orcid.org/0009-0008-3590-9341, carlosbernardogeo@gmail.com; 3 Instituto Municipal de Urbanismo Pereira Passos - IPP: Rua Gago Coutinho, nº52, CEP: 22221-070. Laranjeiras, Rio de Janeiro – RJ – Brasil – https://orcid.org/0009-0007-2797-9967, oliveiralarissauerj@gmail.com; e 4 Instituto Municipal de Urbanismo Pereira Passos - IPP: Rua Gago Coutinho, nº52, CEP: 22221-070. Laranjeiras, Rio de Janeiro – RJ – Brasil – https://orcid.org/0000-0003-2548-3697, rcdecguimaraesfilho@gmail.com

AbstractThis article analyzes the dynamics of the labor market in the city of RJ, especially with regard to the Manufacturing Industry sector. The aim is to understand, through the stock of formal jobs, whether this sector is losing space in the Rio de Janeiro economy, taking into account the years 2006 to 2023. Firstly, the importance of industry for economic development is discussed. Immediately afterwards, the data, which were extracted from RAIS, is discussed. In response, this work concluded that there is a loss in the share of jobs in the Manufacturing Industry in the city's total employment stock, evidencing a process of deindustrialization. Keywords: deindustrialization; transformation industry; formal employment stock; City of Rio de Janeiro; RAIS. ResumoEste artigo analisa a dinâmica do mercado de trabalho da cidade do RJ, sobretudo, no que tange ao setor Indústria de Transformação. Busca-se compreender, por meio do estoque de empregos formais, se tal setor está perdendo espaço na economia carioca, tendo como observância os anos 2006 a 2023. Primeiramente, é debatida a importância da indústria para o desenvolvimento econômico. Logo após, é realizada a discussão dos dados, que foram extraídos da RAIS. Como resposta, este trabalho concluiu que existe perda da participação de empregos da Indústria de Transformação no estoque de empregos totais da cidade, evidenciando um processo de desindustrialização. Palavras-chave: desindustrialização; indústria de transformação; estoque de emprego formal; Cidade do Rio de Janeiro; RAIS. ResumenEste artículo analiza la dinámica del mercado de trabajo en la ciudad de RJ, especialmente en lo que respecta al sector de la Industria de Transformación. El objetivo es entender, a través del stock de empleos formales, si este sector está perdiendo espacio en la economía carioca, teniendo en cuenta los años 2006 a 2023. En primer lugar, se analiza la importancia de la industria para el desarrollo económico. Inmediatamente después se discuten los datos extraídos del RAIS. En respuesta, este trabajo concluyó que existe una pérdida en la participación de los empleos de la Industria Manufacturera en el stock total de empleo de la ciudad, evidenciando un proceso de desindustrialización. Palabras clave: desindustrialización; industria manufacturera; stock de empleo formal; Ciudad de Río de Janeiro; RAIS |

Introduction

With the change of the political bloc in power in Brazil since the beginning of 2023, the industrial issue has become more present and routine in public debate and decision-making, both from a strategic standpoint and from a critical perspective. However, it is fair to say that the country has been undergoing a process of deindustrialization since the early 1980s, marked by financial liberalization, improved terms of trade, and an appreciated exchange rate (Oreiro; Feijó, 2010). More than that, Brazilian deindustrialization is premature.

This premature movement occurs when a nation, even before reaching a high-income level like that of developed countries, begins a process of deindustrialization, causing it to stagnate and remain trapped in the middle-income trap (Oreiro; Feijó, 2010). Among the causes, one can point to external vulnerabilities and ineffective or nonexistent industrial policies. Economic theory also points to the existence of natural deindustrialization, which occurs when a country reaches a high-income level and begins to develop non-industrial sectors that take on a greater share of GDP.

When a nation ceases to be industrialized prematurely, some consequences are observed: reduced productivity and wages, low technological progress, as this is driven mainly by manufacturing sectors, restrictions in the balance of payments, and low long-term growth (Oreiro; Feijó, 2010).

In the Brazilian case, according to the Brazilian Institute of Geography and Statistics (IBGE), in the Monthly Industrial Survey (PIM) between March 2024 and March 2025, industrial production grew by 3.1%. Specifically, in March 2025, this expansion in the General Industry was 1.2%. Despite this, it is worth noting that, in the same month, the Extractive Industry advanced by 3.3%, while the Manufacturing Industry recorded gains of only 0.9%. In this segment, the industrial sectors and/or activities that showed the greatest dynamism were the areas of Manufacture of Pharmaceutical and Medicinal Chemical Products (12%), Manufacture of Furniture (6%), Miscellaneous Products (5.1%), and Manufacture of Apparel and Accessories (4.2%).

In 2023, the IBGE’s Annual Industrial Survey (PIA) indicated that there were 8,526,393 people employed in the industry, of which 8,286,542 were in the Manufacturing Industry, with the food products manufacturing sector being the one that hired the most. Also according to the PIA, the average monthly wage in the Extractive Industry is 5.3 minimum wages, while in the Manufacturing Industry, the average wage is 3 minimum wages.

It is therefore important to examine the industrial labor market in Rio de Janeiro to understand its functioning, especially regarding the Manufacturing Industry, taking into account the creation of formal jobs, the number of people employed, businesses created, their sizes and dynamics, as well as identifying the bottlenecks so that the Rio de Janeiro industry can grow in sectors that add greater value to production. Political decision-making for establishing a development strategy for the city of Rio de Janeiro depends on understanding the local industry and mobilizing society around this strategy (Jabbour, 2020), that is, economic development also involves the industrial growth of the city.

That said, in addition to this introduction, this article will have a theoretical and methodological review section that will address the literature dealing with industry and economic development and methodological notes on data collection and analysis. Next, the results will be presented regarding the general overview of formal jobs and establishments, specifically in Rio de Janeiro’s Manufacturing Industry, covering the two timeframes highlighted in the methodology section. Finally, the concluding remarks and the recommendations of this study will be presented.

Theoretical-Methodological Review

- Industry and Economic Development

It is well known that the industrial sector plays a crucial role in the economic development of any locality, since in addition to generating jobs with higher wages, when compared to earnings in other sectors of the economy such as agriculture, commerce, and services, it also tends to stimulate innovation, education, and drive the creation and improvement of local infrastructure.

According to Furtado (2009), economic development goes beyond the growth of economic indicators and capital accumulation. In the view of the aforementioned author, a region can only be considered economically developed when there are deep structural transformations in society, including changes in productive capacity, as well as institutional, political, and social changes. In other words, economic development is a process of lasting improvement in the population’s living conditions, which is not limited to simple economic growth. From this perspective, industrialization is one of the paths to economic development.

According to specialized literature, the “world” has been experiencing a process of deindustrialization, which should not necessarily be regarded as something negative, as is the case in developed countries. In this circumstance, the decline in industry’s share of employment and value added to GDP (which would constitute deindustrialization) is, to some extent, associated with the transfer of manufacturing activities to developing countries. Thus, this deindustrialization is accompanied by an increase in the production of goods that are intensive in skilled labor and have a high technological level (Ribeiro, Cardozo, and Martins, 2021).

However, deindustrialization has also been occurring in Latin America, and in this case, it can be conjectured that it is not something positive, given that such countries have not yet consolidated the favorable impacts of their late industrialization. Here, “premature deindustrialization” occurs, as the relative expansion of industry is concentrated in lower value-added segments such as agriculture and mining, which tends to limit economic development and the catching-up[1] process of these nations (Tregenna, 2009; Palma, 2005).

In light of this, the analysis of the deindustrialization process in the Brazilian economy has become a matter to be examined, particularly in terms of measurement. In his work entitled Premature Deindustrialization, Rodrik (2016) measures that in developed nations deindustrialization occurs when the country’s per capita income reaches a level below US$ 20,000 in 2016 purchasing power parity (PPP). Applying this logic to Brazil, Morceiro and Guilhoto (2019) point out that the process of deindustrialization in the Brazilian economy began in 1981, when its per capita income was US$ 10,800 (in 2016 PPP), that is, below the threshold estimated by Rodrik (2016). From this perspective, it can be said that Brazil has been undergoing premature deindustrialization, since this process is taking place without the country having exploited all the potential of industry.

The deindustrialization process in the Brazilian economy can be more clearly identified in the 1990s, with the decline of the import substitution model, the reorientation of the State’s role, and the productive restructuring led by multinational companies. Thus, in this new globalist logic, while, for example, China becomes the “world’s factory,” Brazil begins to participate in a passive and subordinate way in the new accumulation model, specializing in the export of raw materials, unprocessed products, or semi-finished goods, which carry low added value (Kupfer, 2009).

This dynamic of Brazil’s export agenda must be seen as a warning to the industrial sector in the different regions of the country, since according to Ribeiro, Cardozo, and Martins (2021), in the 2000s the “Manufacturing Industry” sector in Brazil has been suffering constant losses in its share of Gross Value Added (GVA). In 2004, the GVA of Brazil’s Manufacturing Industry accounted for 17.8% of total GVA, but since then it has weakened, reaching 12.5% in 2017.

In addition, there is a reduction in the share of medium-high and high-technology industries in the structure of the Brazilian industry (Ribeiro, Cardozo, and Martins, 2021). This trend is correlated with the relocation of investments into low value-added industries and/or non-industrialized products, to the detriment of more complex sectors, a process that some economists refer to as the Dutch disease (Bresser-Pereira, 2010; Oreiro; Feijó, 2010).

Finally, it is worth clarifying that the deindustrialization process is also evident at subnational scales, often at a different pace. A significant example is the state of Rio de Janeiro, which is undergoing an accelerated process of deindustrialization, especially in the Manufacturing Industry (Aucar, 2024).

Given the above, it can be understood that Brazil is going through a process of deindustrialization that can be measured in two ways: by the value added by industry to GDP and by the level of industrial employment in the total employment of the economy. Thus, due to the lack of more recent data on the GVA of the city of Rio de Janeiro, the next section aims to understand, through the stock of formal employment, whether Rio de Janeiro’s economy is also undergoing a deindustrialization process. The thesis here is that the inevitable weakening of industrial links in Brazil greatly impacts regional supply chains and the very socioeconomic dynamics of cities grounded in industrial production.

- Methodology

To achieve the proposed objective, this study adopted the comparative-descriptive-explanatory method. In addition, in order to enrich the theoretical foundation, the qualitative method was also employed, using bibliographic research, analysis of secondary data, and official websites.

The statistical data were based on the Relação Anual de Informações Sociais (RAIS). RAIS is an administrative record reported annually by all employers and economic establishments nationwide, with the possibility of municipal disaggregation. It is of great importance, as it can be understood as a “snapshot” in time of a given year regarding the Brazilian formal labor market, providing relevant information such as the total number of establishments and the average remuneration of active formal jobs, thus enabling various structural analyses of this market (Maggi, 2023).

For better understanding, the data presented were divided by sector and subsector of economic activity, according to the classification of the Brazilian Institute of Geography and Statistics (IBGE), in the most recent version of the National Classification of Economic Activities (CNAE 2.3). This classification divides economic activities into eight distinct sectors: (i) Mining; (ii) Manufacturing Industry; (iii) Public Utility Industrial Services; (iv) Civil Construction; (v) Commerce; (vi) Services; (vii) Public Administration; and (viii) Agriculture, Forestry, Hunting, and Fishing (Maggi, 2023).

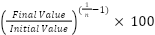

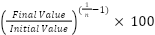

Regarding the time frame, the data were grouped in two ways: first, by the years 2006, 2011, 2016, and 2021, consisting of five-year intervals; and later, by the years 2022 and 2023. This separation was necessary given the break in RAIS’s historical series after 2021, which led to a significant change in the way information is collected and processed, making it impossible to perform a factual comparison with previous years. Furthermore, 2024 data were not included in the study, as they are still partial, reflecting extremely low figures that would bias the analysis. Finally, to complement the understanding of the extracted data, the average annual variation rates were calculated as follows:

(1)

(1)

Where:

Initial Value is the value at the beginning of the period;

Final Value is the value at the end of the period; and

“n” is the number of years elapsed in the period.

The above formula is used to standardize the variation of table values over the analyzed time. For example, if the average annual variation rate indicates that the number of establishments in the “Manufacturing Industry” sector grew by 1% between 2006 and 2021, this means that, on average, this value increased by 1% each year during those 15 years.

Discussion and Results

- General Overview of Formal Jobs

Analyzing the evolution of formal jobs, there is a clear expansion of employment relationships across different federal levels. Comparing the most recent year to the initial year in the sample, there is a 38.6% increase in formal employment nationwide, with an average annual growth rate of 2.2%. In the State of Rio de Janeiro (hereafter, ERJ), the increase in the stock of formal jobs was 16.8%, with an annual growth rate of 1%, while in the Metropolitan Region of Rio de Janeiro (hereafter, RMRJ), the figures show a 12.3% increase in employment relationships and an average annual growth rate of 0.8%. In the same vein, in the municipality of Rio de Janeiro, formal jobs increased by 7.5%, with an average annual growth rate of 0.5%, showing progress, albeit slow (Table 1).

Table 1: Evolution of the Stock of Formal Jobs – Total

Period | Geographic Region |

|

Brazil | State of RJ | RMRJ | City of RJ |

2006 | 35.155.249 | 3.373.627 | 2.563.494 | 1.962.014 |

2011 | 46.310.631 | 4.349.052 | 3.299.911 | 2.497.662 |

2016 | 46.060.198 | 4.159.481 | 3.155.616 | 2.381.304 |

2021 | 48.728.871 | 3.938.871 | 2.878.958 | 2.109.414 |

Percentage Growth |

2006-2021 | 38,6% | 16,8% | 12,3% | 7,5% |

Average Annual Growth Rate |

2006-2021 | 2,2% | 1% | 0,8% | 0,5% |

Source: Own elaboration based on RAIS data, Ministry of Labor and Employment.

When analyzing data related only to the Commerce sector, there is an increase in the level of formal job stock at all spatial scales in the sample. In this regard, the figures reveal, nationwide, a growth of 50.4% with an average annual growth rate of 2.8% for these jobs. In the ERJ, the increase is 23.6%, with an annual growth rate of 1.4%. Furthermore, the RMRJ also shows an expansion in the number of employment relationships, in this case by 16.8% and with an average annual growth rate of 1%. Finally, formal jobs in Commerce in the municipality of Rio de Janeiro rose by 10.5% over the period analyzed, reflecting an average annual growth rate of 0.7% (Table 2).

Table 2: Evolution of the Stock of Formal Jobs – Commerce Sector

Period | Geographic Region |

|

Brazil | State of RJ | RMRJ | City of RJ |

2006 | 6.330.341 | 634.619 | 479.036 | 326.497 |

2011 | 8.842.677 | 825.990 | 612.104 | 409.256 |

2016 | 9.264.904 | 841.106 | 617.581 | 409.492 |

2021 | 9.519.763 | 784.103 | 559.561 | 360.693 |

Percentage Growth |

2006-2021 | 50,4% | 23,6% | 16,8% | 10,5% |

Average Annual Growth Rate |

2006-2021 | 2,8% | 1,4% | 1,0% | 0,7% |

Source: Own elaboration based on RAIS data, Ministry of Labor and Employment.

Regarding the Services sector, the figures are also positive. In Brazil, for instance, during the analysis period there was an increase of 62.2% in formal employment relationships, with an average annual growth rate of 3.3%. It is also noteworthy that such employment relationships have been on the rise since 2006. In the ERJ, there was an increase of 24.6%, with an average variation of 1.5%, in the number of formal jobs. The smallest increases were observed in the RMRJ and the municipality of Rio de Janeiro, with growth rates of 22.3% and 18%, respectively, and average annual growth rates of 1.4% and 1.1% (Table 3).

Table 3: Evolution of the Stock of Formal Jobs – Services Sector

Period | Geographic Region |

|

Brazil | State of RJ | RMRJ | City of RJ |

2006 | 11.229.881 | 1.441.012 | 1.168.822 | 942.184 |

2011 | 15.372.455 | 1.880.392 | 1.547.252 | 1.220.317 |

2016 | 16.708.852 | 1.901.175 | 1.553.159 | 1.219.312 |

2021 | 18.218.425 | 1.795.267 | 1.429.801 | 1.111.732 |

Percentage Growth |

2006-2021 | 62,2% | 24,6% | 22,3% | 18,0% |

Average Annual Growth Rate |

2006-2021 | 3,3% | 1,5% | 1,4% | 1,1% |

Source: Own elaboration based on RAIS data, Ministry of Labor and Employment.

In the context of General Industry[2], the data reveal different scenarios at each spatial scale of analysis. In this sense, it is possible to observe that the largest growth in the stock of formal jobs occurred nationwide, with an increase of 23.1% and an average annual growth rate of 1.4%. Furthermore, formal jobs in the state of Rio de Janeiro also increased, although by a smaller percentage, only 2.2%, with an average annual growth rate of 0.1%, revealing a certain stagnation. On the other hand, both the metropolitan region of the ERJ and the municipality of Rio de Janeiro experienced declines in their respective numbers of formal jobs. In the RMRJ, the decline was -5.8%, while in the city it was -3.8%. These two areas also recorded negative trends in the average annual growth rate, with respective rates of -0.4% and -0.3%. Broadly speaking, this means that for 15 years both the RMRJ and the city of Rio de Janeiro have been losing jobs in the industrial sector (Table 4).

Table 4: Evolution of the Stock of Formal Jobs – General Industry Sector

Period | Geographic Region |

|

Brazil | State of RJ | RMRJ | City of RJ |

2006 | 8.515.982 | 594.941 | 398.634 | 271.019 |

2011 | 11.508.108 | 817.960 | 541.851 | 383.831 |

2016 | 9.784.183 | 660.064 | 430.984 | 309.262 |

2021 | 10.484.504 | 608.030 | 375.345 | 260.774 |

Percentage Growth |

2006-2021 | 23,1% | 2,2% | -5,8% | -3,8% |

Average Annual Growth Rate |

2006-2021 | 1,4% | 0,1% | -0,4% | -0,3% |

Source: Own elaboration based on RAIS data, Ministry of Labor and Employment.

Since the geographic area under study is the city of Rio de Janeiro, Table 5 (see next page) provides a comparison of the total stock of formal jobs among the municipalities belonging to the State of Rio de Janeiro. It is possible to verify, during the observation period, that the city of Rio de Janeiro accounts for a significant share of the state’s formal jobs.

From this perspective, in 2006 the ERJ had about 3.37 million formal jobs, with 1.96 million located in the city of Rio de Janeiro, representing about 58.2%. In 2011, there was an increase in the number of formal jobs in the city, reaching 2.49 million. However, this configuration changed from 2016 onward, when the number of formal jobs decreased to 2.38 million. Finally, 2021 shows a significant worsening in the city’s stock of formal jobs, which dropped to 2.10 million.

This can be explained, among other factors, by the impact of the COVID-19 pandemic, which hit various economic sectors, especially in-person services. Moreover, the loss of the city of Rio de Janeiro’s percentage share of the ERJ’s formal jobs can be explained, beyond the pandemic, by the influence of the oil economy, as the municipalities with the highest growth are involved in the spatial production circuit of oil (Castillo and Frederico, 2010).

Lastly, it is worth noting that the trajectory of the stock of formal jobs in the city of Rio de Janeiro and in the ERJ shows a positive correlation, meaning they follow the same trend. In other words, the direction of the number of registered jobs in the ERJ is driven by the city of Rio de Janeiro.

Table 5: Evolution of the Stock of Formal Jobs in Municipalities Belonging to the State of Rio de Janeiro[3]

Location | 2006 | 2011 | 2016 | 2021 | Average Annual Growth Rate 2006-2021 |

Absolute No. | % | Absolute No. | % | Absolute No. | % | Absolute No. | % |

State of RJ | 3.373.627 | 100% | 4.349.052 | 100% | 4.159.481 | 100% | 3.938.871 | 100% | 1,0% |

Maricá | 8.980 | 0,3% | 13.715 | 0,3% | 15.011 | 0,4% | 27.353 | 0,7% | 7,7% |

Rio das Ostras | 10.012 | 0,3% | 21.829 | 0,5% | 24.920 | 0,6% | 29.523 | 0,7% | 7,5% |

São Pedro da Aldeia | 9.437 | 0,3% | 12.989 | 0,3% | 14.089 | 0,3% | 19.844 | 0,5% | 5,1% |

Seropédica | 7.732 | 0,2% | 11.594 | 0,3% | 13.098 | 0,3% | 14.898 | 0,4% | 4,5% |

Magé | 15.075 | 0,4% | 19.276 | 0,4% | 24.589 | 0,6% | 27.994 | 0,7% | 4,2% |

Queimados | 9.561 | 0,3% | 17.020 | 0,4% | 15.251 | 0,4% | 17.005 | 0,4% | 3,9% |

Itaboraí | 18.837 | 0,6% | 35.624 | 0,8% | 27.981 | 0,7% | 32.184 | 0,8% | 3,6% |

Saquarema | 9.279 | 0,3% | 15.679 | 0,4% | 14.809 | 0,4% | 15.647 | 0,4% | 3,5% |

Resende | 24.739 | 0,7% | 33.338 | 0,8% | 33.500 | 0,8% | 40.084 | 1,0% | 3,3% |

Mesquita | 9.819 | 0,3% | 15.895 | 0,4% | 16.446 | 0,4% | 15.520 | 0,4% | 3,1% |

Araruama | 14.352 | 0,4% | 21.043 | 0,5% | 18.770 | 0,5% | 21.999 | 0,6% | 2,9% |

Belford Roxo | 24.129 | 0,7% | 31.212 | 0,7% | 32.903 | 0,8% | 36.552 | 0,9% | 2,8% |

Cabo Frio | 29.432 | 0,9% | 42.492 | 1,0% | 44.135 | 1,1% | 44.507 | 1,1% | 2,8% |

Itaperuna | 15.122 | 0,4% | 20.225 | 0,5% | 20.696 | 0,5% | 22.695 | 0,6% | 2,7% |

Macaé | 85.297 | 2,5% | 132.709 | 3,1% | 126.871 | 3,1% | 122.420 | 3,1% | 2,4% |

Volta Redonda | 56.812 | 1,7% | 74.893 | 1,7% | 69.870 | 1,7% | 79.929 | 2,0% | 2,3% |

Teresópolis | 27.593 | 0,8% | 34.429 | 0,8% | 36.907 | 0,9% | 37.730 | 1,0% | 2,1% |

São João de Meriti | 41.155 | 1,2% | 57.741 | 1,3% | 56.937 | 1,4% | 56.036 | 1,4% | 2,1% |

Itaguaí | 19.897 | 0,6% | 31.731 | 0,7% | 28.603 | 0,7% | 26.810 | 0,7% | 2,0% |

Duque de Caxias | 122.156 | 3,6% | 180.873 | 4,2% | 156.818 | 3,8% | 151.521 | 3,8% | 1,4% |

Três Rios | 18.002 | 0,5% | 23.524 | 0,5% | 22.655 | 0,5% | 22.238 | 0,6% | 1,4% |

São Gonçalo | 89.036 | 2,6% | 112.087 | 2,6% | 115.129 | 2,8% | 108.186 | 2,7% | 1,3% |

Nova Friburgo | 43.240 | 1,3% | 50.100 | 1,2% | 49.062 | 1,2% | 52.025 | 1,3% | 1,2% |

Nova Iguaçu | 76.735 | 2,3% | 98.111 | 2,3% | 100.544 | 2,4% | 91.297 | 2,3% | 1,2% |

Niterói | 152.573 | 4,5% | 184.758 | 4,2% | 176.847 | 4,3% | 174.586 | 4,4% | 0,9% |

Barra Mansa | 28.183 | 0,8% | 34.973 | 0,8% | 32.514 | 0,8% | 31.845 | 0,8% | 0,8% |

Petrópolis | 59.687 | 1,8% | 73.195 | 1,7% | 69.061 | 1,7% | 66.953 | 1,7% | 0,8% |

Barra do Piraí | 14.522 | 0,4% | 17.242 | 0,4% | 15.516 | 0,4% | 16.209 | 0,4% | 0,7% |

Rio de Janeiro | 1.962.014 | 58,2% | 2.497.662 | 57,4% | 2.381.304 | 57,3% | 2.109.414 | 53,6% | 0,5% |

Angra dos Reis | 33.993 | 1,0% | 43.923 | 1,0% | 36.143 | 0,9% | 36.458 | 0,9% | 0,5% |

Valença | 10.918 | 0,3% | 12.056 | 0,3% | 11.552 | 0,3% | 11.502 | 0,3% | 0,3% |

Nilópolis | 16.625 | 0,5% | 19.218 | 0,4% | 18.097 | 0,4% | 17.022 | 0,4% | 0,2% |

Campos dos Goytacazes | 84.224 | 2,5% | 92.110 | 2,1% | 90.282 | 2,2% | 85.094 | 2,2% | 0,1% |

Rio Bonito | 24.294 | 0,7% | 21.523 | 0,5% | 16.791 | 0,4% | 14.793 | 0,4% | -3,3% |

Mangaratiba | 20.437 | 0,6% | 13.904 | 0,3% | 9.849 | 0,2% | 10.424 | 0,3% | -4,4% |

Other municipalities | 179.728 | 5,3% | 230.359 | 5,3% | 221.931 | 5,3% | 250.574 | 6,4% | 2,2% |

Source: Own elaboration based on RAIS data, Ministry of Labor and Employment.

- General Overview of Formal Jobs in the Manufacturing Industry of Rio de Janeiro

- General Overview of Formal Jobs

When considering data referring only to the Manufacturing Industry, the scenario shows significant differences compared to the total number of formal jobs and some similarities when compared to the General Industry, both analyses described in the previous section.

In this regard, it can be concluded that the increase in the number of formal jobs in the Manufacturing Industry occurred only at the national level, where growth was 15.5% with an average annual growth rate of 1%. Thus, in the other scales of analysis, there was no increase in formal employability in this sector. On the contrary, all declined, with emphasis on the RMRJ and the municipality of Rio de Janeiro, which showed respective losses of -15.5% and -16% (Table 6).

Table 6: Evolution of the Stock of Formal Jobs – Manufacturing Industry of Rio de Janeiro

Period | Geographic Region |

|

Brazil | State of RJ | RMRJ | City of RJ |

2006 | 6.594.783 | 360.996 | 240.043 | 153.298 |

2011 | 8.113.805 | 451.372 | 293.004 | 192.505 |

2016 | 7.148.013 | 382.805 | 241.587 | 159.626 |

2021 | 7.615.740 | 352.953 | 202.799 | 128.762 |

Percentage Growth |

2006-2021 | 15,5% | -2,2% | -15,5% | -16,0% |

Average Annual Growth Rate |

2006-2021 | 1% | -0,2% | -1,1% | -1,2% |

Source: Own elaboration based on RAIS data, Ministry of Labor and Employment.

Continuing, in Table 7, when comparing all industrial segments that make up the General Industry, it is noted that the Mining and Manufacturing Industry sectors had average annual variations of -1.2% each, while the Public Utility Industrial Services and Civil Construction sectors showed positive variations of 1.4% and 0.8%, respectively. The aforementioned table also shows that in 2006 the Manufacturing Industry segment accounted for about 56.6% of the General Industry in the city of Rio de Janeiro. This share gradually lost strength, and by the end of 2021 it accounted for about 49.4%.

Table 7: Evolution of the Stock of Formal Jobs – Sectors of the General Industry of Rio de Janeiro

Segment of General Industry | 2006 | 2011 | 2016 | 2021 | Average Annual Variation 2006/2021 |

Absolute No. | % | Absolute No. | % | Absolute No. | % | Absolute No. | % |

1 - Mining | 13.318 | 4,9% | 11.496 | 3,0% | 8.524 | 2,8% | 11.085 | 4,3% | -1,2% |

2 -Manufacturing Industry | 153.298 | 56,6% | 192.505 | 50,2% | 159.626 | 51,6% | 128.762 | 49,4% | -1,2% |

3 - Public Utility Industrial Services | 31.425 | 11,6% | 42.151 | 11,0% | 37.663 | 12,2% | 38.821 | 14,9% | 1,4% |

4 - Civil construction | 72.978 | 26,9% | 137.679 | 35,9% | 103.449 | 33,5% | 82.106 | 31,5% | 0,8% |

Total industry | 271.019 | 100% | 383.831 | 100% | 309.262 | 100% | 260.774 | 100% | -0,3% |

Source: Own elaboration based on RAIS data, Ministry of Labor and Employment.

Still regarding the Manufacturing Industry, it is possible to observe a significant loss of formal jobs. In 2006 there were about 153,000 jobs in this segment; however, 2021 ended with 128,000 formal jobs, totaling a loss of 24,536 positions. This scenario worsens when comparing the most recent year of the analysis with 2011, with a loss of 63,743 jobs in the Manufacturing Industry of the city of Rio de Janeiro.

Detailing the analysis of the Manufacturing Industry sector in the city of Rio de Janeiro, a general downward trend is observed in the average annual variation, with emphasis on the Footwear Industry (-7.9%), Transportation Equipment (-6.2%), and Paper and Printing (-3.7%). It is worth noting that, in absolute numbers, all subsectors showed decreases when comparing 2016 with 2011. On the other hand, the only subsector to show a positive percentage was the Chemical Industry, with an average annual variation of 1%. However, it is important to highlight that, in absolute terms, this subsector saw a reduction of 10,593 jobs when comparing 2021 with 2011 (Table 8).

Table 8: Evolution of the Stock of Formal Jobs – Subsectors of the Manufacturing Industry of Rio de Janeiro

Subsectors of the Manufacturing Industry | 2006 | 2011 | 2016 | 2021 | Average Annual Variation 2006/2021 |

Absolute No. | % | Absolute No. | % | Absolute No. | % | Absolute No. | % |

2 - Manufacturing Industry | 153.298 | 56,6% | 192.505 | 50,2% | 159.626 | 51,6% | 128.762 | 49,4% | -1,2% |

Non-Metallic Mineral Products | 4.744 | 0,2% | 5.390 | 0,2% | 4.525 | 0,2% | 4.231 | 0,2% | -0,8% |

Metallurgical Industry | 12.530 | 0,6% | 16.689 | 0,7% | 13.172 | 0,6% | 12.269 | 0,6% | -0,1% |

Mechanical Industry | 10.694 | 0,5% | 14.815 | 0,6% | 10.117 | 0,4% | 8.344 | 0,4% | -1,6% |

Electrical and Communication | 4.338 | 0,2% | 3.749 | 0,2% | 3.196 | 0,1% | 2.770 | 0,1% | -2,9% |

Transportation Equipment | 6.719 | 0,3% | 9.455 | 0,4% | 3.571 | 0,1% | 2.560 | 0,1% | -6,2% |

Wood and Furniture | 2.742 | 0,1% | 3.454 | 0,1% | 2.789 | 0,1% | 2.044 | 0,1% | -1,9% |

Paper and Printing | 20.121 | 1,0% | 20.563 | 0,8% | 14.763 | 0,6% | 11.487 | 0,5% | -3,7% |

Rubber, Tobacco, Leather | 11.346 | 0,6% | 13.374 | 0,5% | 11.592 | 0,5% | 11.119 | 0,5% | -0,1% |

Chemical Industry | 24.444 | 1,2% | 39.141 | 1,6% | 38.272 | 1,6% | 28.548 | 1,4% | 1,0% |

Textile Industry | 20.253 | 1,0% | 26.052 | 1,0% | 18.989 | 0,8% | 15.400 | 0,7% | -1,8% |

Footwear Industry | 571 | 0,0% | 677 | 0,0% | 432 | 0,0% | 165 | 0,0% | -7,9% |

Food and Beverages | 34.796 | 1,8% | 39.146 | 1,6% | 38.208 | 1,6% | 29.825 | 1,4% | -1,0% |

Source: Own elaboration based on RAIS data, Ministry of Labor and Employment.

- Overview of Formal Employment

Analyzing Table 9, it is noted that the number of establishments in the Manufacturing Industry sector in the municipality of Rio de Janeiro shows an average annual variation of 1% from 2006 to 2021. Looking at the absolute numbers, there was an increase in the number of manufacturing establishments in Rio, except between 2016 and 2021, when there was a reduction of 298 establishments.

Table 9: Number of Manufacturing Industry Establishments in Rio de Janeiro

Segment of General Industry | 2006 | 2011 | 2016 | 2021 | Average Annual Variation 2006/2021 |

Absolute No. | % | Absolute No. | % | Absolute No. | % | Absolute No. | % |

1 - Mining | 377 | 1,9% | 490 | 2,0% | 522 | 1,9% | 432 | 1,6% | 0,9% |

2 - Manufacturing Industry | 13.511 | 67,9% | 15.133 | 61,6% | 16.044 | 58,9% | 15.746 | 58,7% | 1,0% |

3 - Public Utility Industrial Services | 376 | 1,9% | 594 | 2,4% | 799 | 2,9% | 1.011 | 3,8% | 6,8% |

4 - Civil Construction | 5.647 | 28,4% | 8.344 | 34,0% | 9.895 | 36,3% | 9.622 | 35,9% | 3,6% |

Total Industry | 19.911 | 100% | 24.561 | 100% | 27.260 | 100% | 26.811 | 100% | 2,0% |

Source: Own elaboration based on data from RAIS, Ministry of Labor and Employment.

Breaking down the branches of the Manufacturing Industry, Table 10 shows a highlight for the Rubber, Tobacco, and Leather subsector. This subsector presents significant increases, with an average annual variation of 6.3% over the analyzed period, representing growth of around 1,000 establishments every five years. The Mechanical Industry and Food and Beverages subsectors, although less expressive, also achieved positive percentages, with respective annual averages of 2.7% and 2.2%.

On the other hand, the subsector of the Manufacturing Industry that most decreased over time in the city of Rio de Janeiro was the Footwear Industry, with an average annual variation of -4.9%, and only 29 establishments recorded in 2021. Furthermore, the Chemical Industry, Textile Industry, and Mechanical Industry subsectors also displayed concerning trajectories, with respective annual averages of -3%, -2.5%, and -2%.

Table 10: Number of Establishments by Subsector of the Manufacturing Industry of Rio de Janeiro

Subsectors of the Manufacturing Industry | 2006 | 2011 | 2016 | 2021 | Average Annual Variation 2006/2021 |

Absolute No. | % | Absolute No. | % | Absolute No. | % | Absolute No. | % |

2 - Manufacturing Industry | 13.511 | 100% | 15.133 | 100% | 16.044 | 100% | 15.746 | 100% | 1% |

Non-Metallic Mineral Products | 363 | 2,7% | 357 | 2,4% | 332 | 2,1% | 287 | 1,8% | -1,6% |

Metallurgical Industry | 1.231 | 9,1% | 1.256 | 8,3% | 1.128 | 7,0% | 912 | 5,8% | -2,0% |

Mechanical Industry | 840 | 6,2% | 1.002 | 6,6% | 1.238 | 7,7% | 1.261 | 8,0% | 2,7% |

Electrical and Communication | 334 | 2,5% | 295 | 1,9% | 323 | 2,0% | 307 | 1,9% | -0,6% |

Transport Equipment | 239 | 1,8% | 286 | 1,9% | 304 | 1,9% | 288 | 1,8% | 1,3% |

Wood and Furniture | 497 | 3,7% | 562 | 3,7% | 501 | 3,1% | 476 | 3,0% | -0,3% |

Paper and Printing | 2.473 | 18,3% | 2.935 | 19,4% | 2.778 | 17,3% | 2.340 | 14,9% | -0,4% |

Rubber, Tobacco, Leather | 1.882 | 13,9% | 2.637 | 17,4% | 3.708 | 23,1% | 4.691 | 29,8% | 6,3% |

Chemical Industry | 1.281 | 9,5% | 1.192 | 7,9% | 1.039 | 6,5% | 815 | 5,2% | -3,0% |

Textile Industry | 2.304 | 17,1% | 2.426 | 16,0% | 2.090 | 13,0% | 1.578 | 10,0% | -2,5% |

Footwear Industry | 62 | 0,5% | 52 | 0,3% | 37 | 0,2% | 29 | 0,2% | -4,9% |

Food and Beverages | 2.005 | 14,8% | 2.133 | 14,1% | 2.566 | 16,0% | 2.762 | 17,5% | 2,2% |

Source: Own elaboration based on RAIS data, Ministry of Labor and Employment.

Finally, considering Table 11, it can be observed that the stock of formal jobs, according to the size of the establishment, in the Manufacturing Industry of Rio de Janeiro decreased in all ranges except in the last one, which corresponds to establishments with 1,000 or more employment ties. In this range, there was an average annual variation of 3.1%, with a stock of 37,898 formal jobs in 2021.

Table 11: Stock of Formal Jobs, by Size of Establishment, in the Manufacturing Industry of Rio de Janeiro

Establishment Size | 2006 | 2011 | 2016 | 2021 | Average Annual Variation 2006/2021 |

Absolute No. | % | Absolute No. | % | Absolute No. | % | Absolute No. | % |

From 1 to 4 | 5.429 | 3,5% | 5.774 | 3,0% | 6.224 | 3,9% | 5.267 | 4,1% | -0,2% |

From 5 to 9 | 9.389 | 6,1% | 8.941 | 4,6% | 8.378 | 5,2% | 6.285 | 4,9% | -2,6% |

From 10 to 19 | 14.451 | 9,4% | 14.255 | 7,4% | 12.236 | 7,7% | 10.523 | 8,2% | -2,1% |

From 20 to 49 | 22.796 | 14,9% | 24.721 | 12,8% | 19.913 | 12,5% | 15.201 | 11,8% | -2,7% |

From 50 to 99 | 18.541 | 12,1% | 19.508 | 10,1% | 11.957 | 7,5% | 10.408 | 8,1% | -3,8% |

From 100 to 249 | 24.550 | 16,0% | 26.023 | 13,5% | 17.693 | 11,1% | 15.764 | 12,2% | -2,9% |

From 250 to 499 | 20.691 | 13,5% | 24.943 | 13,0% | 19.701 | 12,3% | 15.766 | 12,2% | -1,8% |

From 500 to 999 | 13.518 | 8,8% | 13.781 | 7,2% | 15.885 | 10,0% | 11.650 | 9,0% | -1,0% |

1.000 or more | 23.933 | 15,6% | 54.559 | 28,3% | 47.639 | 29,8% | 37.898 | 29,4% | 3,1% |

Total Manufacturing Industry | 153.298 | 100% | 192.505 | 100% | 159.626 | 100% | 128.762 | 100% | -1,2% |

Source: Own elaboration based on RAIS data, Ministry of Labor and Employment.

- Most Recent Analyses – Years 2022 and 2023

- Stock of Formal Jobs in Rio de Janeiro’s Manufacturing Industry

As mentioned in the Methodology section, it was necessary to analyze the years 2022 and 2023 separately from the others, given the break in the RAIS historical series after 2021, which caused a significant change in how the information was collected and processed.

Thus, Table 12 shows that, in the cited years, the General Industry of the city of Rio de Janeiro recorded gains in the balance of formal jobs. Notably, the Manufacturing Industry ended 2023 with 146,117 formal positions, reflecting a gain of almost 4 thousand jobs compared to 2022, and an average annual variation of 2.8%. However, it is worth noting that in 2021 the Manufacturing Industry’s share in the General Industry was 49.4%, a portion reduced to 46.1% by the end of 2023.

Table 12: Evolution of the Stock of Formal Jobs – Sectors of Rio de Janeiro’s General Industry

Segment of General Industry | 2022 | 2023 | Average Annual Variation 2022/2023 |

Absolute No. | % | Absolute No. | % |

1 - Mining | 12.769 | 4,4% | 13.575 | 4,3% | 6,3% |

2 - Manufacturing Industry | 142.180 | 49,3% | 146.117 | 46,1% | 2,8% |

3 - Civil Construction | 43.450 | 15,1% | 41.232 | 13,0% | -5,1% |

4 - Construção Civil | 90.096 | 31,2% | 115.795 | 36,6% | 28,5% |

Total Industry | 288.495 | 100% | 316.719 | 100% | 9,8% |

Source: prepared by the authors based on RAIS data, Ministry of Labor and Employment.

Focusing the analysis on the subsectors of Rio de Janeiro’s Manufacturing Industry reveals some concerning scenarios. For example, the Footwear Industry subsector lost about 65 jobs from one year to the next, showing an average annual variation of -35.5% (Table 13).

Table 13: Evolution of the Stock of Formal Jobs – Subsectors of Rio de Janeiro’s Manufacturing Industry

Subsectors of the Manufacturing Industry | 2022 | 2023 | Average Annual Variation 2022/2023 |

Absolute No. | % | Absolute No. | % |

2 - Manufacturing Industry | 142.180 | 3,5% | 146.117 | 3,6% | 2,8% |

Non-Metallic Mineral Products | 4.293 | 0,1% | 4.367 | 0,1% | 1,7% |

Metallurgical Industry | 13.143 | 0,3% | 13.133 | 0,3% | -0,1% |

Mechanical Industry | 11.292 | 0,3% | 11.442 | 0,3% | 1,3% |

Electrical and Communication | 2.806 | 0,1% | 2.377 | 0,1% | -15,3% |

Transportation Equipment | 2.631 | 0,1% | 2.380 | 0,1% | -9,5% |

Wood and Furniture | 2.263 | 0,1% | 2.409 | 0,1% | 6,5% |

Paper and Printing | 10.790 | 0,3% | 11.147 | 0,3% | 3,3% |

Rubber, Tobacco, Leather | 11.617 | 0,3% | 11.705 | 0,3% | 0,8% |

Chemical Industry | 29.433 | 0,7% | 31.006 | 0,8% | 5,3% |

Textile Industry | 15.942 | 0,4% | 14.576 | 0,4% | -8,6% |

Footwear Industry | 183 | 0,0% | 118 | 0,0% | -35,5% |

Food and Beverage | 37.787 | 0,9% | 41.457 | 1,0% | 9,7% |

Source: prepared by the authors based on RAIS data, Ministry of Labor and Employment.

In absolute numbers, the largest loss of jobs occurred in the Textile Industry subsector, with 1,366 fewer positions in the comparison between 2022 and 2023. On the positive side, the Food and Beverage and Chemical Industry subsectors stand out, with increases of 3,670 and 1,573 jobs, respectively. Due to this balance between growth and decline, but with more intense losses in small sectors, the city’s Manufacturing Industry remained favorable in the analysis period, showing an average annual growth of 2.8% (also Table 13).

- Quantity and Size of Establishments in the Manufacturing Industry of Rio de Janeiro

Analyzing the extracted data, it is possible to observe that the average annual variation rate in the number of establishments in the Manufacturing Industry sector of Rio de Janeiro shows a growth of 3.5%, which in practice represents a gain of 238 units from 2022 to 2023 (Table 14).

Table 14: Number of Establishments in the Manufacturing Industry of Rio de Janeiro

Segment of General Industry | 2022 | 2023 | Average Annual Variation 2022/2023 |

Absolute No. | % | Absolute No. | % |

1 - Mining Industry | 156 | 1,3% | 151 | 1,2% | -3,2% |

2 - Manufacturing Industry | 6.812 | 56,8% | 7.050 | 55,2% | 3,5% |

3 - Public Utility Industrial Services | 334 | 2,8% | 357 | 2,8% | 6,9% |

4 - Civil Construction | 4.700 | 39,2% | 5.215 | 40,8% | 11,0% |

Total Industry | 12.002 | 100% | 12.773 | 100% | 6,4% |

Source: authors’ own elaboration based on RAIS data, Ministry of Labor and Employment.

Looking more closely at the details of the Manufacturing Industry sector, Table 15 shows that the subsector with the highest growth in terms of average annual variation was the Footwear Industry, with an increase of 22.2%.

Table 15: Number of Establishments by Economic Activity Subsector in the Manufacturing Industry of Rio de Janeiro

Subsectors of the Manufacturing Industry | 2022 | 2023 | Average Annual Variation 2022/2023 |

Absolute No. | % | Absolute No. | % |

2 - Manufacturing Industry | 6.812 | 100% | 7.050 | 100% | 3,5% |

Non-metallic Mineral Products | 222 | 3,3% | 226 | 3,2% | 1,8% |

Metallurgical Industry | 546 | 8,0% | 569 | 8,1% | 4,2% |

Mechanical Industry | 665 | 9,8% | 698 | 9,9% | 5,0% |

Electrical and Communication | 172 | 2,5% | 177 | 2,5% | 2,9% |

Transport Equipment | 173 | 2,5% | 174 | 2,5% | 0,6% |

Wood and Furniture | 252 | 3,7% | 259 | 3,7% | 2,8% |

Paper and Printing | 778 | 11,4% | 794 | 11,3% | 2,1% |

Rubber, Tobacco, Leather | 719 | 10,6% | 727 | 10,3% | 1,1% |

Chemical Industry | 509 | 7,5% | 484 | 6,9% | -4,9% |

Textile Industry | 866 | 12,7% | 868 | 12,3% | 0,2% |

Footwear Industry | 9 | 0,1% | 11 | 0,2% | 22,2% |

Food and Beverages | 1.901 | 27,9% | 2.063 | 29,3% | 8,5% |

Source: authors’ own elaboration based on RAIS data, Ministry of Labor and Employment.

The Food and Beverage subsector, although less expressive, also achieved a positive rate, with an annual average of 8.5%, representing growth of around 162 establishments from one year to the next. On the other hand, the only subsector that showed negative figures was the Chemical Industry, with an average annual variation of -4.9% and a reduction of 25 establishments from 2022 to 2023 (also on Table 15).

Finally, regarding the stock of formal jobs by establishment size, it is noted that the Manufacturing Industry of Rio de Janeiro shows negative percentages in two size ranges, namely: establishments with 100 to 249 employees, whose average annual variation was -9.9%, which in absolute terms means a loss of 1,702 formal jobs; and establishments with 250 to 499 employees, with an average annual variation of -0.3%, which in technical terms can be considered stability in that volume of formal jobs. On the positive side, the range of establishments with 50 to 99 employees stands out, with an average annual growth of 14.4%, that is, an increase of 1,795 jobs (Table 16).

Table 16: Stock of Formal Jobs, by Establishment Size, in the Manufacturing Industry of Rio de Janeiro

Establishment Size | 2022 | 2023 | Average Annual Variation 2022/2023 |

Absolute No. | % | Absolute No. | % |

From 1 to 4 | 6.159 | 4,3% | 6.420 | 4,4% | 4,2% |

From 5 to 9 | 7.802 | 5,5% | 8.077 | 5,5% | 3,5% |

From 10 to 19 | 11.959 | 8,4% | 12.079 | 8,3% | 1,0% |

From 20 to 49 | 18.128 | 12,8% | 19.527 | 13,4% | 7,7% |

From 50 to 99 | 12.466 | 8,8% | 14.261 | 9,8% | 14,4% |

From 100 to 249 | 17.127 | 12,0% | 15.425 | 10,6% | -9,9% |

From 250 to 499 | 15.150 | 10,7% | 15.109 | 10,3% | -0,3% |

From 500 to 999 | 9.983 | 7,0% | 10.109 | 6,9% | 1,3% |

1.000 or more | 43.406 | 30,5% | 45.110 | 30,9% | 3,9% |

Total Manufacturing Industry | 142.180 | 100% | 146.117 | 100% | 2,8% |

Source: authors’ own elaboration based on RAIS data, Ministry of Labor and Employment.

Conclusion

Within the scope of the analysis undertaken in this article, it is concluded, based on the share of industrial jobs in the total employment of the economy, that the city of Rio de Janeiro has been experiencing a process of deindustrialization since 2016.

Throughout this study, a decline in the total employment stock of Rio de Janeiro’s economy between 2016 and 2021 is evident. Following the same trend are the Services, General Industry, and Manufacturing Industry sectors, all showing decreases in formal employment during these periods. In contrast, the Commerce sector showed an increase in the stock of formal jobs in 2016, but a reduction by the end of 2021.

It is worth noting that, at the close of 2021, all sectors of Rio de Janeiro’s economy displayed drops in their respective stocks of formal jobs, a fact linked to the COVID-19 pandemic. However, according to Maggi (2023), even before the health crisis, the labor market as a whole had already been undergoing a process of precarization and a loss in the importance of the industrial sector.

In this context, examining the degree of participation of the Manufacturing Industry’s employment stock in the total number of jobs in the city’s economy, the process of deindustrialization becomes clear, as industry loses ground. Table 17 shows that the Total Industry’s share in the productive structure has decreased: in 2011, its share was 15.4%, but it has steadily declined since then, reaching 12.4% in 2021.

Table 17: Evolution of the Stock of Formal Jobs – By Sectors of Rio de Janeiro’s Economy

Period | Stock of Formal Jobs in the City of Rio de Janeiro |

Total | Commerce | % | Services | % | General Industry | % | Manufacturing Industry | % |

|

2006 | 1.962.014 | 326.497 | 16,6% | 942.184 | 48,0% | 271.019 | 13,8% | 153.298 | 7,8% |

|

2011 | 2.497.662 | 409.256 | 16,4% | 1.220.317 | 48,9% | 383.831 | 15,4% | 192.505 | 7,7% |

|

2016 | 2.381.304 | 409.492 | 17,2% | 1.219.312 | 51,2% | 309.262 | 13,0% | 159.626 | 6,7% |

|

2021 | 2.109.414 | 360.693 | 17,1% | 1.111.732 | 52,7% | 260.774 | 12,4% | 128.762 | 6,1% |

|

Source: authors’ own elaboration based on RAIS data, Ministry of Labor and Employment.

That said, this article argues that the city of Rio de Janeiro is in need of a reindustrialization policy to boost its industrial sector and, consequently, the municipality’s economic development. It is timely to point out the need for the construction of an industrial development plan focused primarily on high value-added industries. For this, the conservatism of economic policy is a major obstacle to achieving more ambitious goals and should be set aside. Thus, what is advocated here is a reindustrialization program guided by the Furtadian tradition, in which the State must take the lead in the process through integrated actions in financing, research, and innovation incentives, strengthening local universities and research centers, as well as investing in urban and transport infrastructure, among other measures.

References

AUCAR, L. Indústria e crescimento econômico do Rio de Janeiro (2002-2021): Características setoriais e intensidade da desindustrialização fluminense. Cadernos do Desenvolvimento Fluminense, Rio de Janeiro, n. 27, 2025. DOI: 10.12957/cdf.2024.87251. Available at: https://www.e-publicacoes.uerj.br/cdf/article/view/87251. Accessed on: 2 jul. 2025.

BRESSER-PEREIRA, L. C.; MARCONI, N. Existe doença holandesa no Brasil? In: BRESSER-PEREIRA, L. C. (org.). Doença holandesa e indústria. Rio de Janeiro: Fundação Getúlio Vargas, 2010.

CASTILLO, R.; FREDERICO, S. Espaço geográfico, produção e movimento: uma reflexão sobre o conceito de circuito espacial produtivo. Sociedade & Natureza, Uberlândia, v. 22, n. 3, p. 461-474, dez. 2010.

FURTADO, C. Desenvolvimento e subdesenvolvimento. Rio de Janeiro: Contraponto, 2009.

IBGE – Instituto Brasileiro de Geografia e Estatística. Pesquisa Industrial Anual – (PIA): Brasil. Rio de Janeiro: IBGE, 2022. Available at: https://www.ibge.gov.br/estatisticas/economicas/industria/9053-pesquisa-industrial-anual-producao.html. Accessed on: 30 jun. 2025.

IBGE – Instituto Brasileiro de Geografia e Estatística. Pesquisa Industrial Mensal – Produção Física (PIM-PF): Brasil. Rio de Janeiro: IBGE, 2023. Available at: https://www.ibge.gov.br/estatisticas/economicas/industria/9227-producao-industrial-mensal-pim-pf-brasil.html. Accessed on: 30 jun. 2025.

Jabbour, E. K. China: Desenvolvimento e Socialismo de Mercado / Elias Khalil Jabbour. – 1ª ed. Florianópolis: LABEUR, GCN, CFH, UFSC, 2020.

KUPFER, D. Em busca do setor ausente. In: SICSÚ, J.; CASTELAR, A. Sociedade e economia: Estratégias de crescimento e desenvolvimento. Brasília, DF: Ipea, 2009.

MAGGI, D. M. Trabalho em Vertigem: a evolução do mercado de trabalho brasileiro entre 2002 e 2019. In: XVIII Encontro Nacional da ABET, nº 18, 2023, Brasília.

MORCEIRO, P. C.; GUILHOTO, J. M. Desindustrialização setorial e estagnação de longo prazo na manufatura brasileira. Nereus/USP, TD n. 1, 2019.

OREIRO, J. L.; FEIJÓ, C. A. Desindustrialização: conceituação, causas, efeitos e o caso brasileiro. Revista de Economia Política, v. 30, n. 2, p. 219-232, 2010.

PALMA, G. Four Sources of Industrialization and a New Concept of the Dutch Disease. In: OCAMPO, J. A. Beyond reforms, structural dynamics and macroeconomic vulnerability. Stanford: Stanford University Press, 2005. chap. 3, p. 71-116.

RIBEIRO, C. G.; CARDOZO, S. A.; MARTINS, H. Dinâmica regional da indústria de transformação no Brasil (2000-2017). Revista brasileira de estudos urbanos e regionais. v. 23, E202120, 2021. DOI 10.22296/2317-1529.rbeur.202120.

RODRIK, D. Premature Deindustrialization. Journal of Economic Growth, v. 21, n. 1, p. 1-33, 2016.

TREGENNA, F. Characterising deindustrialisation: An analysis of changes in manufacturing employment and output internationally. Cambridge Journal of Economics, v. 33, issue 3, p. 433-466, 2009.

About the Authors

Naiara Silva de Carvalho holds a master’s degree in Economics from Universidade Federal de Uberlândia and works as an economist at UN-Habitat, in partnership with the Pereira Passos Institute for Urbanism of the city of Rio de Janeiro.

Carlos Augusto de Oliveira Bernardo is an undergraduate student in Geography at Universidade do Estado do Rio de Janeiro and an intern in geoprocessing at the Pereira Passos Institute of the city of Rio de Janeiro.

Larissa de Araújo Oliveira is an undergraduate student in Geography at Universidade do Estado do Rio de Janeiro and an intern in geoprocessing at the Pereira Passos Institute of the city of Rio de Janeiro.

Ronald Cardoso de Castro Guimarães Filho is an undergraduate student in Geography at Universidade do Estado do Rio de Janeiro and an intern in geoprocessing at the Pereira Passos Institute of the city of Rio de Janeiro.

Author Contributions

Conceptualization, N.S.C, C.A.O.B, L.A.O, R.C.C.G.F.; methodology, C.A.O.B, R.C.C.G.F.; software, C.A.O.B, L.A.O, R.C.C.G.F.; validation, N.S.C, C.A.O.B, L.A.O, R.C.C.G.F.; formal analysis, N.S.C.; investigation, N.S.C, C.A.O.B, L.A.O, R.C.C.G.F.; resources, N.S.C, C.A.O.B, L.A.O, R.C.C.G.F.; data curation, C.A.O.B, L.A.O, R.C.C.G.F.; writing—original draft preparation, N.S.C, C.A.O.B, L.A.O, R.C.C.G.F.; writing—review and editing, N.S.C.; visualization, N.S.C.; supervision, N.S.C.

Data Availability

The data for this research may be available in the Annual Social Information Report (RAIS), a system of the Ministry of Labor and Employment (MTE).

Conflicts of Interest

The authors declare no conflicts of interest.

About Coleção Estudos Cariocas

Coleção Estudos Cariocas (ISSN 1984-7203) is a publication dedicated to studies and research on the Municipality of Rio de Janeiro, affiliated with the Pereira Passos Institute (IPP) of the Rio de Janeiro City Hall.

Its objective is to disseminate technical and scientific production on topics related to the city of Rio de Janeiro, as well as its metropolitan connections and its role in regional, national, and international contexts. The collection is open to all researchers (whether municipal employees or not) and covers a wide range of fields — provided they partially or fully address the spatial scope of the city of Rio de Janeiro.

Articles must also align with the Institute’s objectives, which are:

- to promote and coordinate public intervention in the city’s urban space;

- to provide and integrate the activities of the city’s geographic, cartographic, monographic, and statistical information systems;

- to support the establishment of basic guidelines for the city’s socioeconomic development.

Special emphasis will be given to the articulation of the articles with the city's economic development proposal. Thus, it is expected that the multidisciplinary articles submitted to the journal will address the urban development needs of Rio de Janeiro.

[1] It is understood as the process by which developing countries reduce the technological and economic gap in relation to more developed countries, generally by adopting the technologies and practices of those countries and, eventually, innovating.

[2] In this study, “General Industry” is considered as the sum of data referring to the following sectors: Manufacturing Industry, Mining, Public Utility Industrial Services, and Civil Construction.

[3]Municipalities ordered in ascending order of average annual variation.